YEAR IN REVIEW: REAL ESTATE DURING A GLOBAL PANDEMIC

March 31, 2022

Year in Review: Real Estate during a Global Pandemic

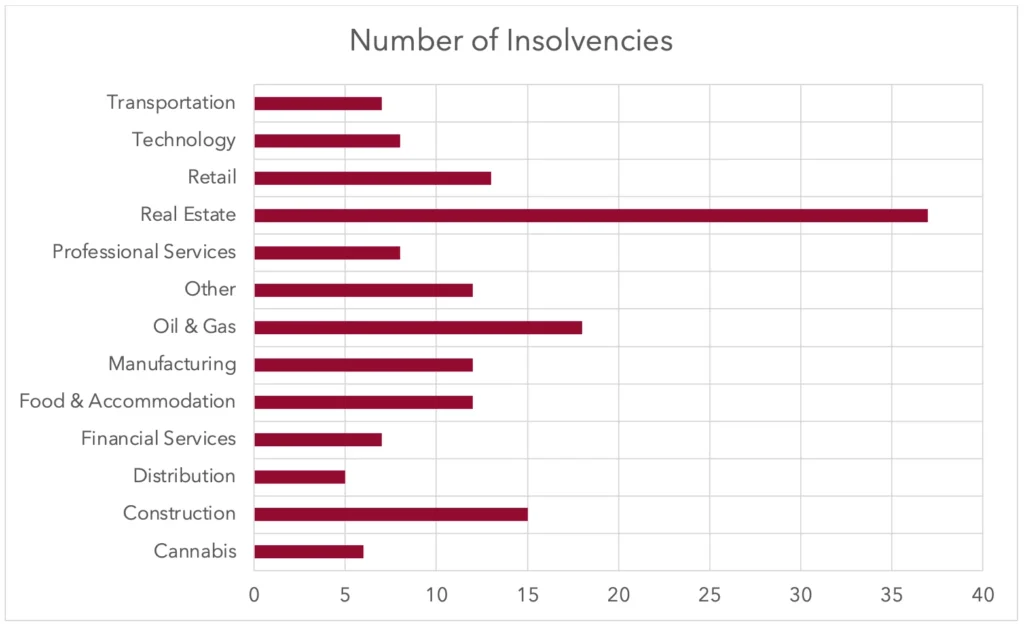

In 2021, there were approximately 200 insolvency filings across Canada – 99 of which were filed in Ontario. Due in large part to the aftereffects of the pandemic and rising material and labour costs, Real Estate led all industries with 37 insolvencies.

Looking specifically at the Greater Toronto Area, developing and managing commercial and residential real estate takes enormous financial planning and support as a result of skyrocketing land, property, and construction costs.

As the economic landscape shifted, some landlords and developers were caught off guard and unable to adapt. Furthermore, sectors such as retail, office, and hospitality faced plummeting revenues – with real estate being their most valuable assets and their fastest path to a successful restructuring.

Source: Insolvency Insider.

Summary

Therefore, we expect the expedient sale of real estate to remain a key strategy for Licensed Insolvency Trustees and insolvent businesses to quickly unlock liquidity and repay debtors.

We also believe that, in the unfortunate case of an insolvency or bankruptcy, it is imperative for relevant Parties to access the most accurate real estate intelligence, as well as the appropriate guidance and sales strategy.

Our team can help provide the best approach to maximize value and recovery. Through our market surveys, underwriting, and valuations, we can ensure you have the highest-quality data and up-to-date knowledge when proceeding with real-estate-related matters. Please contact us today should you or your Clients require further assistance.