WILL MORE INDUSTRIAL SPACE FINALLY BECOME AVAILABLE?

May 5, 2022

Will More Industrial Space Finally Become Available?

Sudden shocks to any system will throw it out of balance until it can reach a new equilibrium. We saw this occur across the global industrial market and – even more acutely – in the Greater Toronto Area in the aftermath of the pandemic.

Millions of consumers turned to their phones and laptops to get the goods they needed while at home. This proliferation of e-commerce translated into an insatiable need for logistics and warehousing space to fulfil orders in a timely manner; fundamentally changing the entire industrial landscape overnight.

As a result, slack in the market was quickly absorbed. Availabilities began inching lower and lower each quarter until today, where less than 1% of industrial space is readily offered for purchase or for lease. The consensus among industry experts is that things will remain constrained for years to come.

That all said, a number of headwinds are putting the entire narrative into question. Major players such as Amazon have announced a pullback in their acquisition, leasing, and development of new space. At the same time, development charges are proposed to increase dramatically, while material and labour costs continue to escalate rapidly. As a result, lead times and uncertainty are lengthening. Meanwhile, industrial land values and industrial rents are skyrocketing with each passing week, making both developers and occupiers question the feasibility and long-term viability of some projects.

All of these factors are thought to increase values and tighten the market further. However, they are also contributing to other risks which may see momentum shift as stakeholders tap out and re-evaluate their options.

Today, we will explore these issues further, and try to determine if we have indeed reached an inflection point in the Greater Toronto industrial market.

Have All-Time Low Industrial Availabilities Reached a Tipping Point?

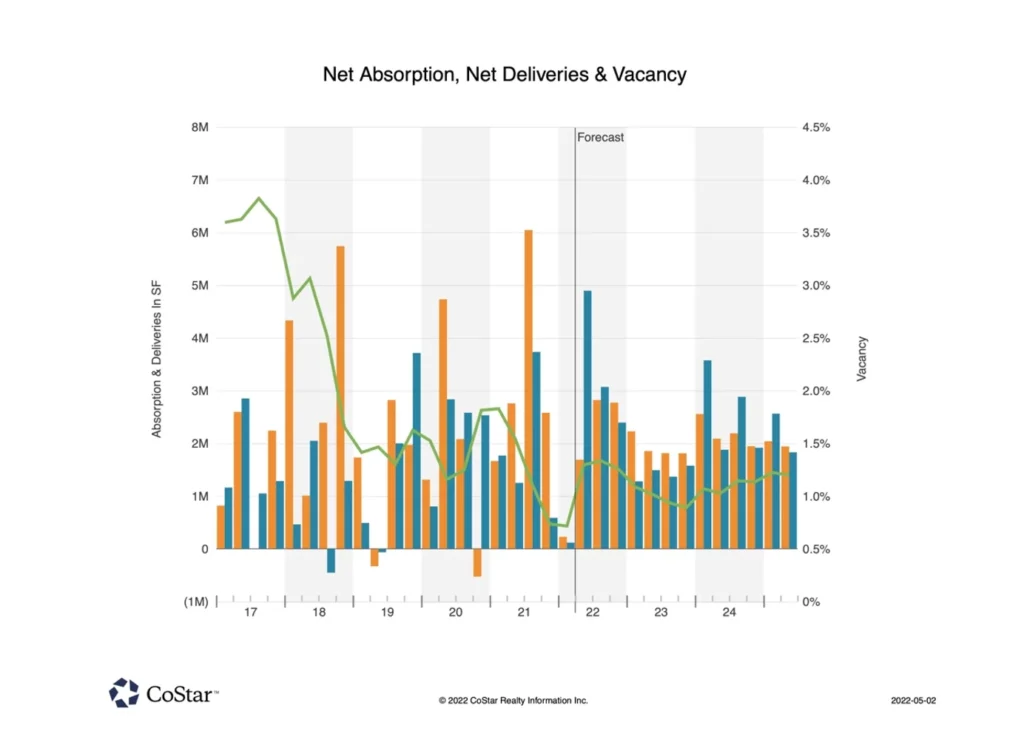

The Greater Toronto industrial market is at all-time low availabilities, with enormous supply constraints hampering the delivery of new product over the past 24 months. The bounce-back effect, however, is that a surge of new deliveries will hit the market in 2022, with just under 5 million square feet coming online in Q2 2022.

GTA Industrial Absorption, Deliveries, & Vacancy – Properties over 50k SF. Source: CoStar.

This flood of space is expected to increase availabilities up to 1.3% in Q2 2022, providing some relief. The question then becomes how quickly the market will be able to absorb it, or if it is still digesting its previous buffet.

Increasing Risk to Developers and Occupiers

As we have alluded to, the current economic environment is so fraught with risk and uncertainty that both supply and demand may be negatively impacted; where previously demand was riding a high from the structural shift to e-commerce and delivery services.

For example, development charges in the GTA are proposed to be increased by 50%. Coupled with accelerating material, labour, and industrial land costs, developers are seeing project timelines lengthen, complexity and risk arise, and margins slimming on new development.

The end result is higher values and rents are being passed down to future tenants, while lead times keep them waiting longer to take possession. Which leads to our final question…

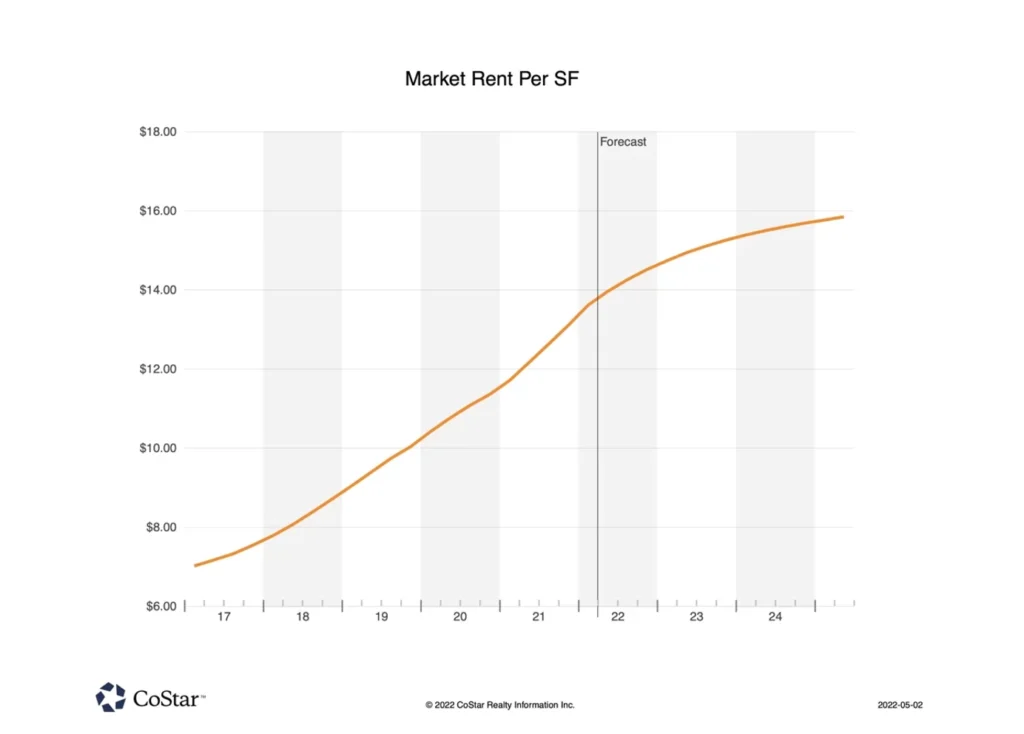

Will Values and Rents Destroy Demand?

As new headleases are signed and existing leases come up for renewal, many occupiers are questioning whether or not they can afford to pay double – or even triple, for specialty facilities – the real estate costs they negotiated, in some cases, just 5 years ago.

GTA Industrial Rents – Properties over 50k SF. Source: CoStar.

Local occupiers may consider consolidating or even relocating to secondary and tertiary markets, while multinational firms may delay entry or expansion into the GTA. Landlords and tenants alike may find more comfort in short-term leases, not knowing where the market may move, or what their business plans will look like in 2-3 years.

All in all, when costs go from being expensive to prohibitive, there tends to be a portion of demand that is destroyed as stakeholders walk from the marketplace. If and when this occurs, we may see the market begin to normalize and fall into a longer-term equilibrium.

Summary

Overall, the GTA industrial logistics market is red-hot, with all-time-low availabilities and supply challenges, despite the possibility that pressure may alleviate in the coming months and years. This environment will see businesses looking to fulfil their growth plans by planning ahead and considering their options between the Greater Toronto Core and secondary markets, such as the Greater Golden Horseshoe and Greater Hamilton Areas.

However, with space becoming increasingly difficult to secure in a timely manner, businesses with logistics and warehousing operations should also consider build-to-suit developments or joint-venture projects with reputable developers. While this option may take anywhere from 18 to 24 months to complete, it will ensure you have the right facility for your needs.

Many of our clients are approaching us looking to pre-lease or develop, and our team has access to specialists who can help guide and manage the process from inception through move-in.

On that note, if you would like our team to assist with any of your real estate needs, or if you would like to discuss anything mentioned in this article, please contact us directly.