THE IMPACT OF MATERIAL SHORTAGES ON LOGISTICS REAL ESTATE

April 8, 2022

The Impact of Material Shortages on Logistics Real Estate

Under normal circumstances, planning your real estate needs is relatively straightforward. As the executive teams are able to forecast growth and understand how much space will be needed, real estate directors – in collaboration with local brokers – can search for suitable space within the appropriate target markets.

That said, uncertain times have made it difficult to accurately predict future demand. They have also made businesses consider various strategies as it pertains to stockpiling excess inventory, procuring source material, simplifying SKU counts, onshoring manufacturing, and dealing with labour shortages.

Meanwhile, most of the major industrial markets across North America are experiencing an unprecedented lack of inventory. This trend has led to an explosion in development and skyrocketing industrial land values. As availabilities inch towards zero percent, the natural conclusion is space will be allocated years in advance; in line with developers’ pipelines and the rate at which municipalities designate more land for employment.

To make matters worse, material shortages are making design builds, or build-to-suits, more challenging to complete on time and on budget.

As a result, many retailers, 3PLs, and transportation companies are being forced to wait, make quick decisions, or pay a significant premium for any readily available space or new development.

In our last issue, we explored the impact of warehouse management systems and how logistics facilities operators are improving throughput as a way to adapt to the space and labour crunch. This week, we will examine the impact of rising material costs and their scarcity on the availability of logistics and warehousing real estate.

Material Input Bottlenecks and Commercial Real Estate

Developing a modern logistics and warehousing facility is an elaborate process involving a team of specialists; from brokers and planners to architects, engineers, and construction managers.

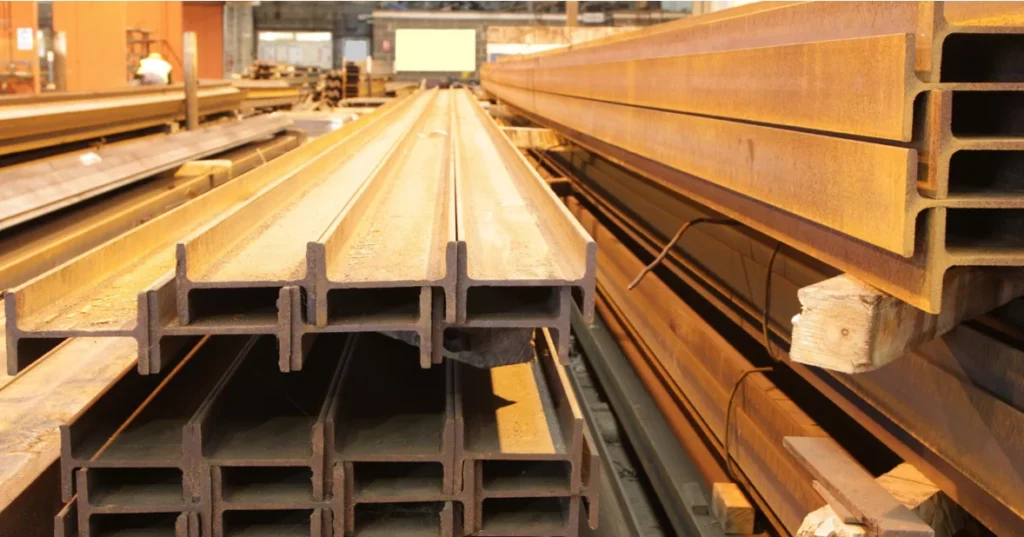

Looking from a high level, the most common materials used today are steel for joists, joist girders, wire mesh, and beams, as well as concrete for the slab and pre-cast. Other inputs include electrical, masonry, lumber, roofing, and mechanical equipment such as for HVAC systems.

Traditionally, orders that would have taken anywhere from 6 weeks to 3 months have ballooned considerably. Steel orders have almost doubled to 10-12 weeks. Pre-cast varies, although construction managers are reporting lead times anywhere from 8-12 months out.

And mechanical equipment that is typically manufactured and shipped in from the United States has been difficult to secure due to the border, supplier labour shortages, and trucking shortages. Likewise, our American counterparts are finding it difficult to import Canadian lumber. These bottlenecks have forced developers in both countries to reconsider building designs and construction methods, as well as to adapt their project timelines.

Finally, as logistics tenants have had a greater need for taller ceiling heights, larger bay sizes, and additional power capacity, the amount and cost of input materials has also noticeably increased.

All of these factors mean that deliveries are taking longer and longer, while the cost to construct is increasing anywhere from 10% to 20% each year, depending on the project. Take into account the competition for space that does come on stream, and we can begin to understand exactly why industrial rents and values are moving up so quickly.

Summary

Overall, the GTA industrial logistics market is red-hot, with all-time-low availabilities and supply challenges. This environment will see businesses looking to fulfil their growth plans by planning well in advance and considering various strategies, from pre-leasing new construction to finding opportunities off the market.

However, with space becoming increasingly difficult to secure in a timely manner, businesses with logistics and warehousing operations should also consider build-to-suit developments or joint-venture projects with reputable developers. While this option may take anywhere from 18 to 24 months to complete, it will ensure you have the right facility for your needs.

Many of our clients are approaching us looking to pre-lease or develop, and our team has access to specialists who can help guide and manage the process from inception through move-in.

On that note, if you would like our team to assist with any of your real estate needs, or if you would like to discuss anything mentioned in this article, please contact us directly.