THE HUNT FOR GTA LOGISTICS DEVELOPMENT OPPORTUNITIES

December 2, 2021

The Hunt For GTA Logistics Development Opportunities

With all-time low availabilities of logistics (and more broadly, industrial) real estate across the GTA, many businesses are considering taking back control through pre-leasing or developing their own facilities.

Similarly, institutional and private developers are looking to deploy capital and are – in some cases – unable to do so quickly enough through the acquisition of available existing properties.

As a result, we see many of these groups scooping up industrial land with plans to construct large, ‘Big Box,’ class-A industrial buildings with a heavy bias towards logistics tenants; with clear heights, shipping capabilities, and location being key features.

However, just as industrial properties are scarce and growing ever-more expensive by the day, so is industrial land. Given its finite nature, as well as the complexity of zoning and plan approvals, we see industrial land values skyrocketing to new highs.

With this in mind, let’s explore industrial land suitable for logistics facility development across the GTA, including what to expect in terms of pricing and location.

GTA Industrial Land Suitable for Logistics Development

For the purposes of this article, we examined all land across the major GTA regions that is zoned as industrial and greater than 5 acres in size. These criteria represent a starting point for a prospective business or developer looking to purchase and construct a logistics-focused industrial property.

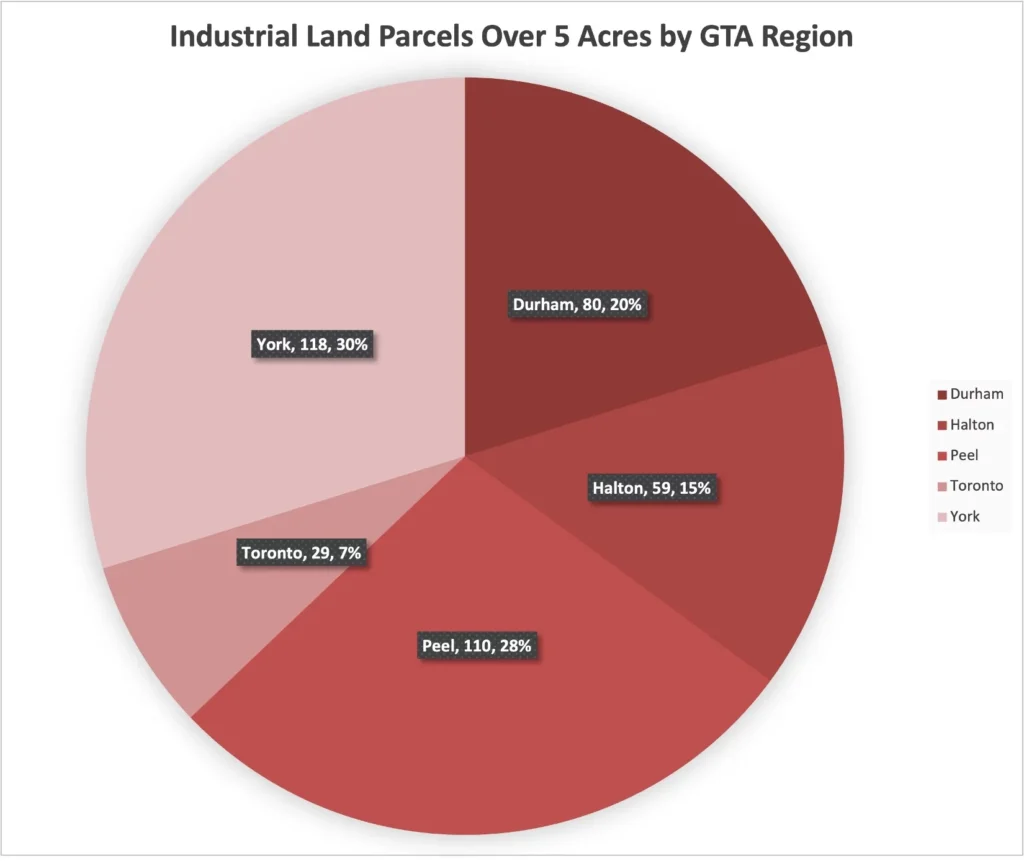

Below, Figure 1 shows a breakdown of 396 industrial parcels that were tracked as fitting our criteria. As depicted, York Region leads the way with 118 parcels, followed by Peel Region with 110; Durham Region with 80, Halton Region with 59, and Toronto with 29. The Western GTA markets account for 43% of industrial land parcels – while the North markets have 30%, the East 20%, and the Toronto core just 7%.

Figure 1: Industrial-zoned land parcels over 5 acres, region. Source: CoStar

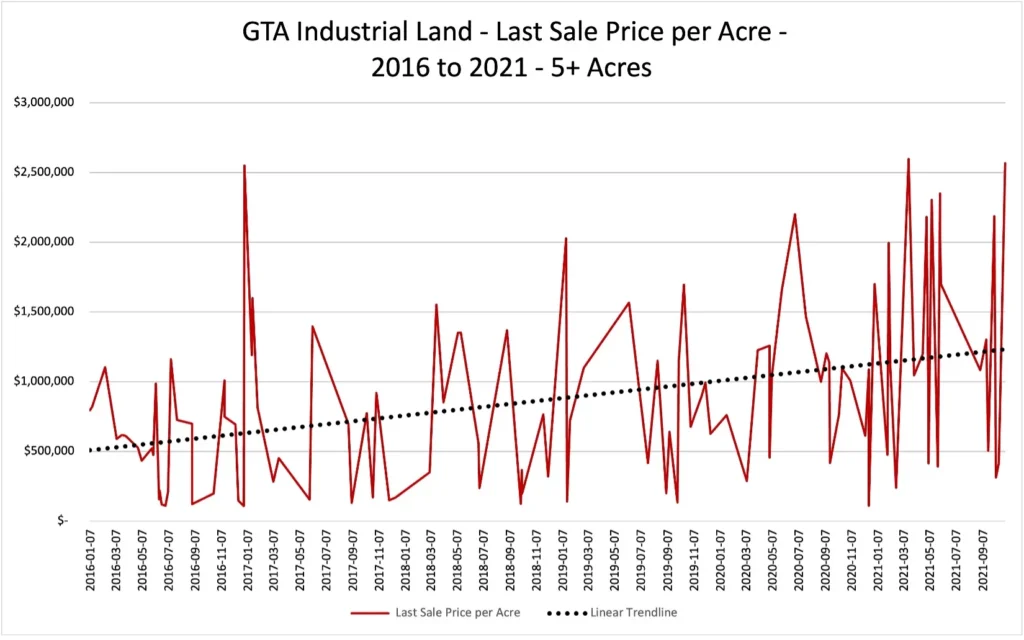

Next, Figure 2 shows the last recorded sales value per acre of industrial land over 5 acres from 2016 to 2021. Our sample size was n=115 and is a subset of the previous chart for parcels where a sales value was recorded in the aforementioned timeframe.

What we see in the chart below is a steady trendline from an approximate average of $500,000 per acre in 2016, to an approximate average of $1.25M per acre in 2021. This represents a 250% increase in per-acre pricing over the past 5 years.

Figure 2: Pricing of industrial land over 5 acres, 2016 to 2021. Source: CoStar.

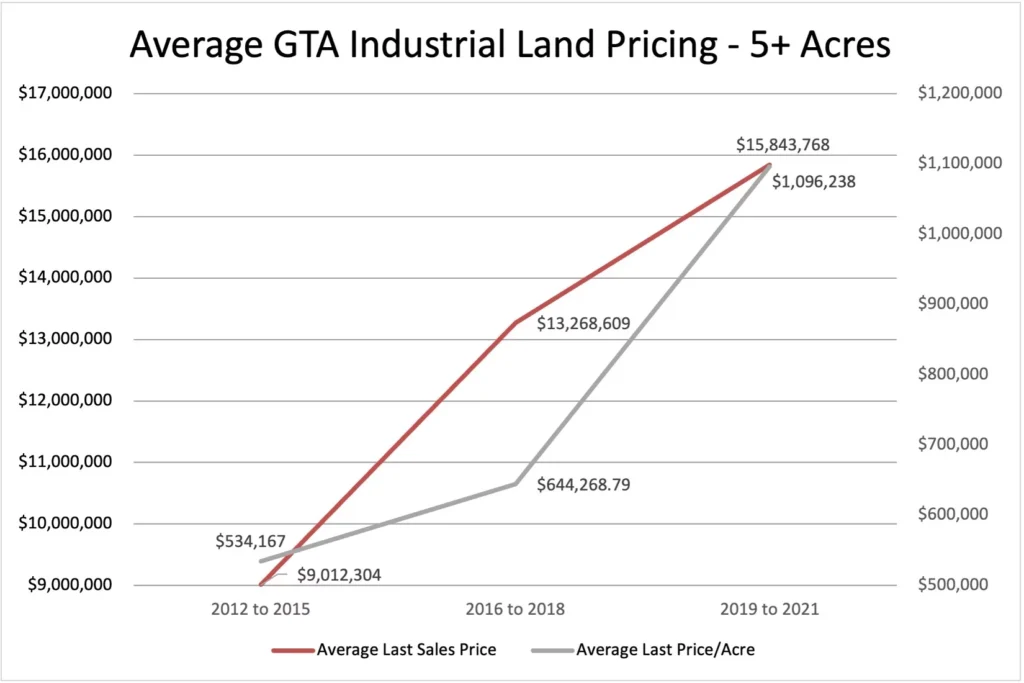

Finally, we looked at the average pricing of industrial land during the periods of 2012 to 2015, 2016 to 2018, and 2019 to 2021; based on recorded sales. We notice the average sales price increased from about $9M to $13.2M to $15.8M, respectively, while the average sales price per acre increased from approximately $530k to $644k to $1.1M, respectively.

Figure 3: Average pricing of industrial land across time. Source: CoStar.

Summary

Overall, the GTA industrial logistics market is red-hot and continues to experience supply challenges. This environment will see rents and values further increasing, spurring retailers and 3PLs to further consider purchasing industrial land and developing or pre-leasing one to two years in advance. The issue still remains that new construction will provide little relief until at least 2023.

Although we approach peak season, starting the conversation about your real estate footprint and examining your options on an ongoing basis will help you find the best facility for your needs when the time is right.

On that note, if you would like our team to help you secure your next facility, for more information on specific industrial land parcels, or off-market opportunities, please contact us directly.