THE AGE OF $1 LISTINGS: THE COMPELLING ADVANTAGES AND SLIPPERY SLOPE

March 2, 2022

The Age of $1 Listings: The Compelling Advantages and Slippery Slope Downside

As the business landscape becomes increasingly competitive, every professional is looking for that edge with which to differentiate themselves. One of the methods we see talked about in growing popularity is the concept of strategy.

Strategy can help to identify opportunity. It can push you over the edge when pitching for business. It can be the difference between mediocrity or excellence. It can make or break deals.

One strategy in particular has recently gained traction in the commercial real estate world.

And that is the use of “$1 listings.”

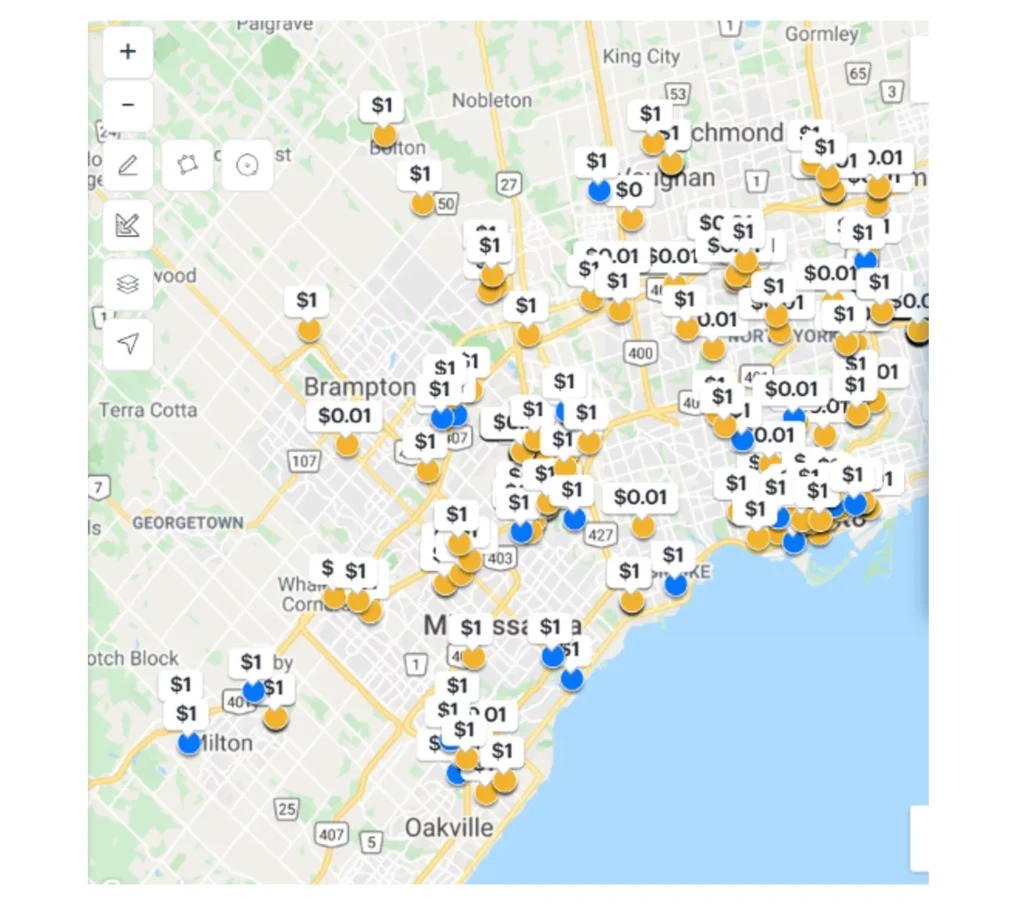

Dollar Listings Across GTA

The case for listing commercial assets for a dollar, whether for sale or for lease, is quite simple.

In an economic landscape where commercial real estate is highly sought-after and where supply is constrained by factors such as construction delays, labour shortages, material costs, and simple land scarcity, owners of commercial properties and land are already in the driver’s seat. Prized assets routinely see competitive bidding scenarios with multiple offers pushing values beyond ask. As a result, Sellers have the opportunity to easily move their pricing targets, especially if one was never set in the first place.

It can be advantageous to an owner to not ‘tip their hand,’ so to speak, from the onset. This tends to yield the highest price and best terms because the pressure, and the responsibility, falls on the Purchaser or Tenant to make the first move and establish a value that they feel will be seriously considered.

That said, is there potentially a ‘slippery slope’ downside to this strategy?

When overused, will this approach eventually harm the Seller and/or the Broker representing them?

First off, let’s explore this situation from an investment perspective. Even with pricing disclosed, Investors looking to purchase commercial assets already find themselves in a competitive environment. Deals move quickly. And every missed shot represents time, energy, and money invested in exploring opportunities.

With dollar listings, Buyers are forced to undergo the exhausting process of valuing assets and playing a guessing game with the Seller, all while having no clear indication of where they stand. This translates into a waning appetite, possible resentment, and an erosion of trust. Questions begin to arise whether there is something being hidden, or if there is more to the story that they just don’t understand.

From the Broker’s perspective, it too, can be frustrating to introduce a Buyer to an asset and have the process go sideways. Not from a commission standpoint, but rather, from tapping into your relational capital to get a Buyer to submit an offer in the first place.

This begs the question, what is the value of engaging a Broker?

Are we expected to consult and provide insight based on our expertise?

And while listing an asset for a dollar can be strategic at times; is establishing a price not central to our very role?

Underwriting assets provides us with a level of certainty and precision. Positioning an asset to its highest and best use allows us to unlock value for our Clients. Running a process lets the market dictate outcomes and gives both Buyers and Sellers transparency and confidence. We build trust when we stand behind a number and defend it through an understanding of comparables, asset characteristics, and market conditions. But more importantly, these methods help us differentiate ourselves in a saturated market.

While dollar listings are but a hammer in the toolbox, perhaps we shouldn’t view every opportunity as a nail.