STATE OF THE GTA LOGISTICS MARKET

November 18, 2021

State of the GTA Logistics Market

For business owners, real estate managers, and operations executives, making real estate decisions in a rapidly-changing landscape can be challenging. Despite knowing your key metrics and performance indicators, it can be almost impossible to predict supply and demand when the data doesn’t adhere to historical figures. This is especially true during the ongoing supply chain crisis, a red-hot real estate market, and worker and material shortages.

However, staying on top of the market – which includes understanding the drastic change in costs, current availabilities, as well as future deliveries – can provide you with the knowledge you need to pull the trigger when the time is right. As we find ourselves quickly approaching ‘peak season,’ opportunities continue to be scarce. And for those companies with growth plans in the coming year and beyond, exploring your options on a regular basis helps mitigate the risk of not having enough space to fulfill your customers’ needs, as well as capture market share.

Let’s examine the current state of the GTA industrial logistics market.

Key Metrics for GTA Logistics Facilities over 50k SF

- Rents: $12.06 PSF (+14.2% Year over Year)

- Vacancy: 0.9% (-0.8% from 1 Year Ago)

- Inventory: 372 million SF (+0.7% Year over Year)

- 12-month net deliveries: 2.5 million SF

- 12-month net absorption: 5.4 million SF

- Under construction: 5.8 million SF (+34% Year over Year)

- Market sale price: $227 PSF (+18.2% Year over Year)

- Cap rate: 4.4% (-0.2% from 1 Year Ago)

Looking at the key metrics above, we notice a further tightening of the GTA logistics market – with rents and values increasing significantly over the past year. Furthermore, absorption continues to outpace new deliveries – much of which is typically pre-leased – and, despite a jump in construction, new space that makes it to market is not enough to satisfy demand.

Notable GTA Industrial Leasing Transactions

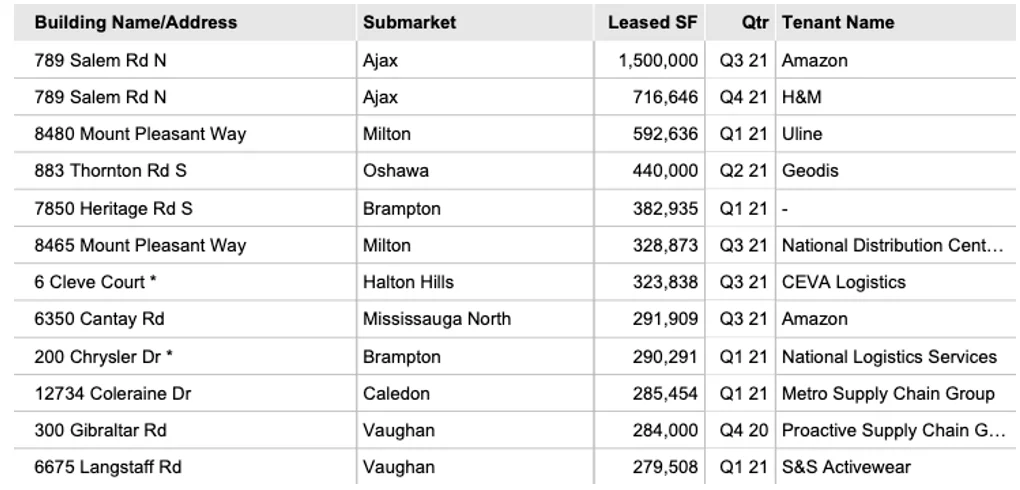

Figure 1 captures the top industrial leasing transactions by size across the GTA over the past 12 months. As is expected, retailers and 3PLs dominate the list, which is heavily biased towards the West and East submarkets.

Figure 1: Top 12 Leasing Transactions from Past 12 Months. Source: CoStar.

GTA Logistics Pipeline of New Construction

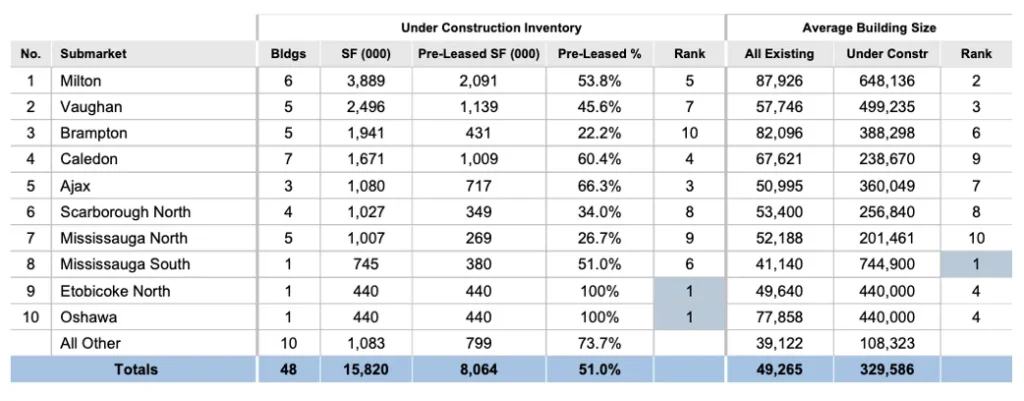

Complementing the table above, Figure 2 outlines new industrial construction by submarket. Some important takeaways:

- The average size of new construction is head and shoulders above the average size of all existing industrial properties, thanks to the demand for ‘Big Box’ warehousing.

- Approximately 8.1M SF out of 15.8M SF – or 51% of new construction – has been pre-leased, with the balance likely being shopped around or in the process of being accounted for.

- Brampton and Mississauga-North lead the way in terms of available space (a combined approximate 2.25M SF), while Etobicoke-North and Oshawa are fully pre-leased (according to existing data) despite having 880,000 SF of new construction being delivered.

Figure 2 – Industrial Construction by Submarket. Source: CoStar.

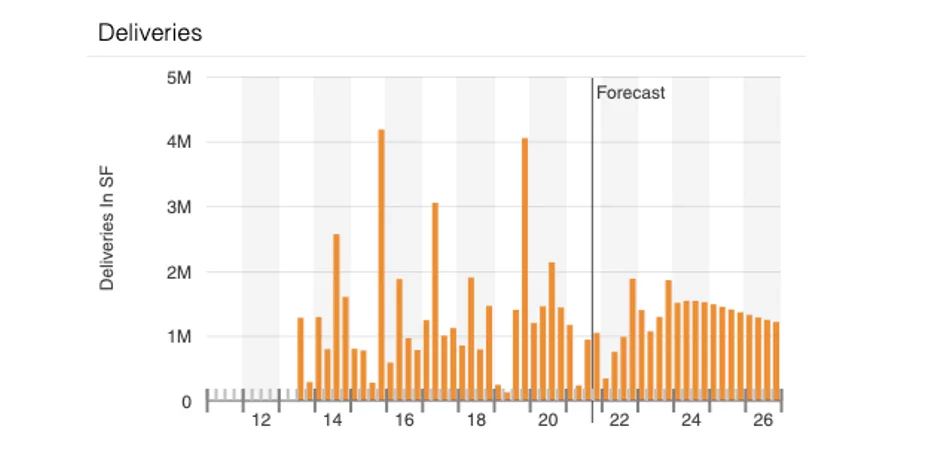

Finally, Figure 3 depicts historical and forecast data for new deliveries. Important to note is that construction of new inventory is still ramping up due to the effects of the pandemic and the ensuing shortages and postponements. This tells us that, coupled with high-% pre-leasing, we do not expect significant relief to supply until late-2022.

Figure – 3 – Historical and Forecast GTA Industrial Deliveries. Source: CoStar.

Summary

The GTA industrial logistics market is red-hot and continues to experience supply challenges. This environment will see rents and values further increasing, with new construction providing little relief until at least 2023.

Retailers and 3PLs will undoubtedly deal with a hectic peak season over the coming months and come away with feedback and lessons as it relates to their real estate footprints. Although it will be a busy period, starting the conversation and examining your options on an ongoing basis will help you find the best facility for your needs when the time is right.

On that note, if you would like our team to assist with your next lease or purchase, or for more market intel or off-market opportunities, please contact us directly.