THE IMPACT OF LAND AVAILABILITY AND NEW CONSTRUCTION ON INDUSTRIAL SUPPLY

July 15, 2021

A Detailed Analysis of the GTA Industrial Market

The industrial real estate market has undergone a revitalization, rebranding – and – a renaissance over the past 10 to 15 years. From what was once considered the least glamorous asset class has now become ‘cool’ with its cutting-edge facilities sometimes spanning dozens of football fields and housing companies at the intersection of Big Tech, New Age Manufacturing, and Same-Day Logistics.

While the companies using this industrial space have quickly ramped up their operations by absorbing existing supply and any new construction, it would seem that the market underestimated their appetite. Developers, institutional and private investors, and owner-occupiers alike have worked tirelessly and have built millions upon millions of square feet of class A space. Yet, for a number of reasons, the GTA industrial market still faces a chronic shortage.

As a result, and as we outlined in the previous article of this series, industrial tenants are waking up to the realization that they are likely facing a steep hike in their rent. Over the past decade, rental rates have – in some cases – more than doubled in certain submarkets and for facilities with certain sought-after features, such as clear heights, location, and shipping. Businesses with 10-year leases coming due are often unaware of the steady but sudden shift that has taken place.

This dramatic change begs the question: is the current environment demand- or supply-driven… or both? While trends such as the explosive growth in e-commerce, transportation, cold storage, biomanufacturing, and even film production are all contributing to the demand for industrial space, these phenomena affect most major markets across North America.

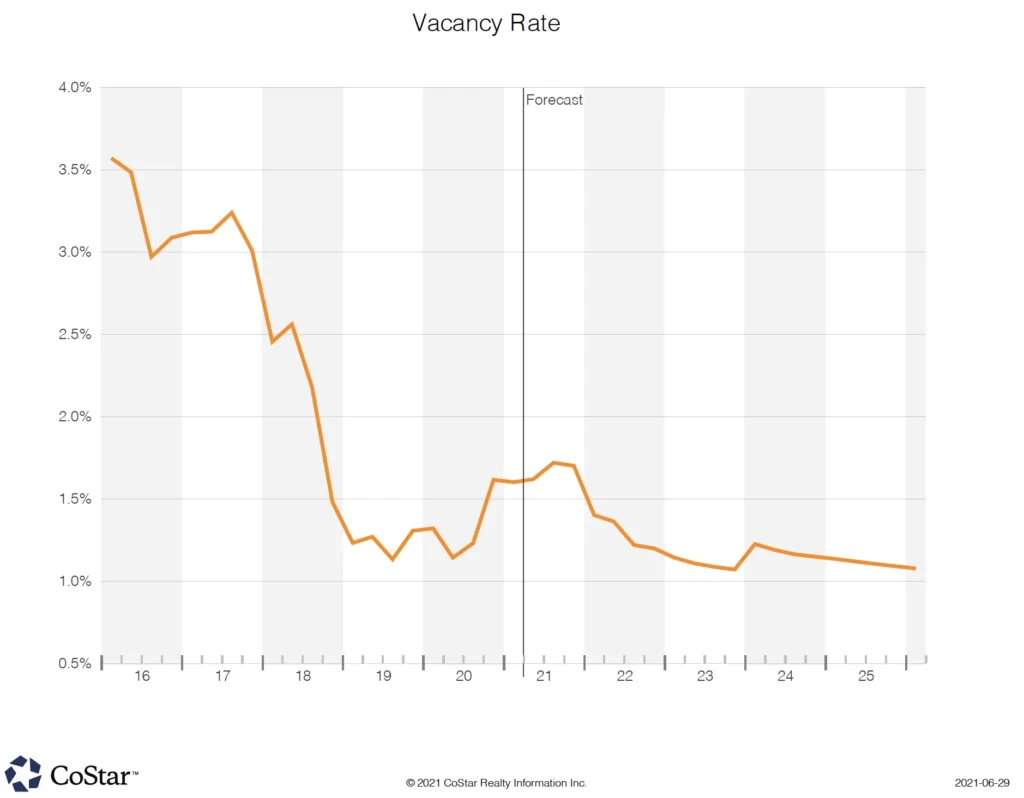

So, when one sees that, for example, the average industrial vacancy across the United States is approximately 4.5% – about 3-4x higher than that in the Greater Toronto Area – one should ask why. Therefore, all else being equal, we can infer that supply – or the lack thereof – must account for the relative difference.

So, with that said, let us examine some of the factors behind the chronic lack of supply in the Greater Toronto Industrial market, and how it may impact your investment strategy or search for industrial space.

Industrial Land: Scarce and Expensive

Investors and developers are always focused on the market; with particular attention paid to movements in pricing, prime land availabilities, changes in planning and zoning, forecasted incoming supply, and recent transactions.

The flurry of leasing and acquisitions that soaked up much of the available space over the past 5 years – as seen in Figure 1 – signaled to market stakeholders that not only was there increasingly strong demand, but it proved that the market could easily bear new supply. In fact, we could theoretically build back to a healthy level of 4 to 5% vacancy without much concern of saturation. That being said, and as well mentioned earlier, the development pipeline could just not keep up.

Fig-1: GTA Industrial Vacancy Rate – Historical and Forecast – Source: CoStar

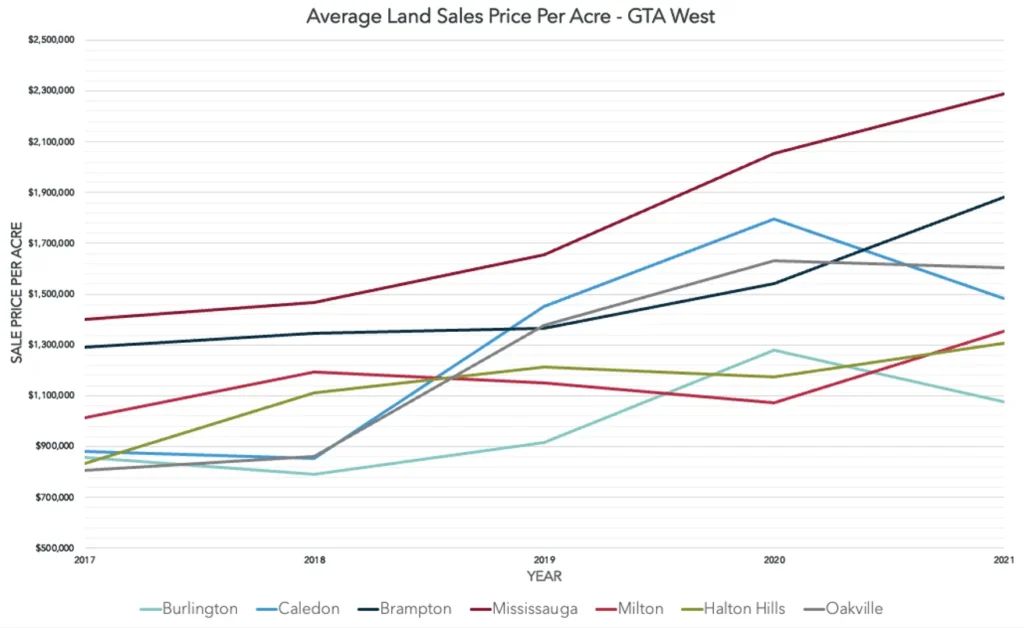

As you see below in Figure 2, the increased market activity led to the average land sales price per acre doubling over the period of 2017 to 2021. This pattern holds true across most of the submarkets across the Greater Toronto Area; with the major Western submarkets depicted below.

Fig-2: Average Land Sales Price Per Acre – GTA West – Source: RealNet

The Pipeline of Future Industrial Supply

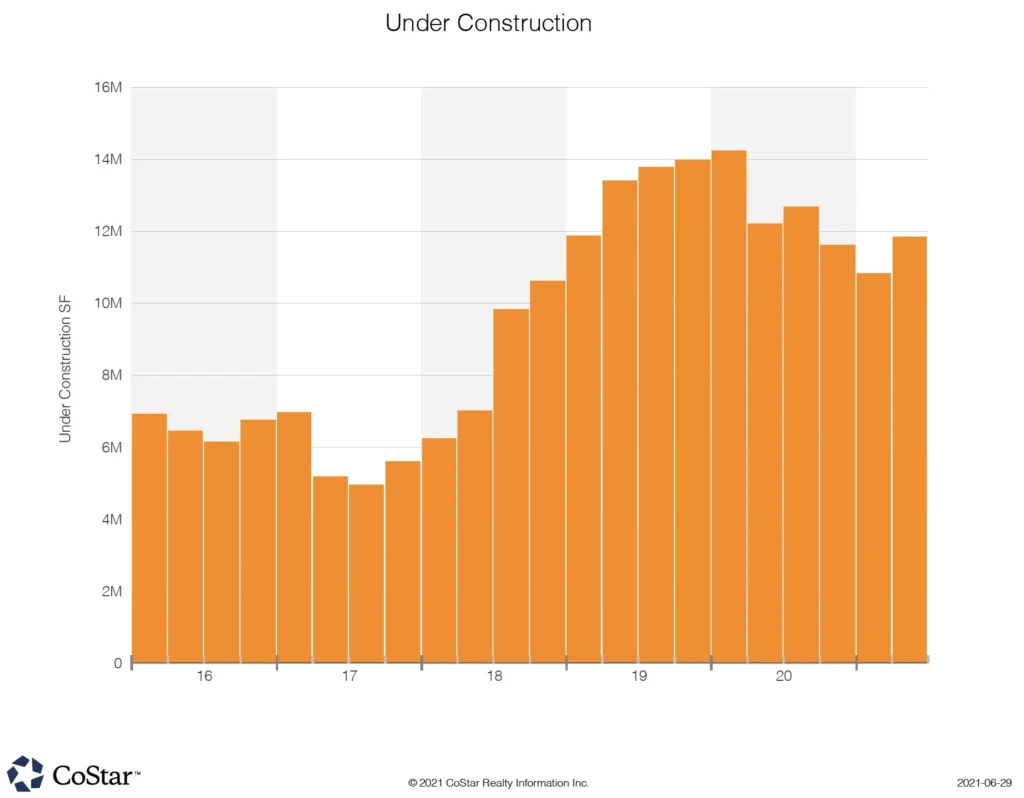

There is currently approximately 12 million square feet of industrial supply under construction in the Greater Toronto Area (as shown in Figure 3). New construction projects have ramped up significantly since late-2017. Even during the period of major economic shutdowns from early-2020 through mid-2021, the development pipeline has outpaced levels from any time prior to late-2018. That in itself is proof of the commitment from the real estate community, as well as the expectations of Industrial Users that space must be built.

Fig-3: Industrial SF Under Construction (Millions) – Source: CoStar

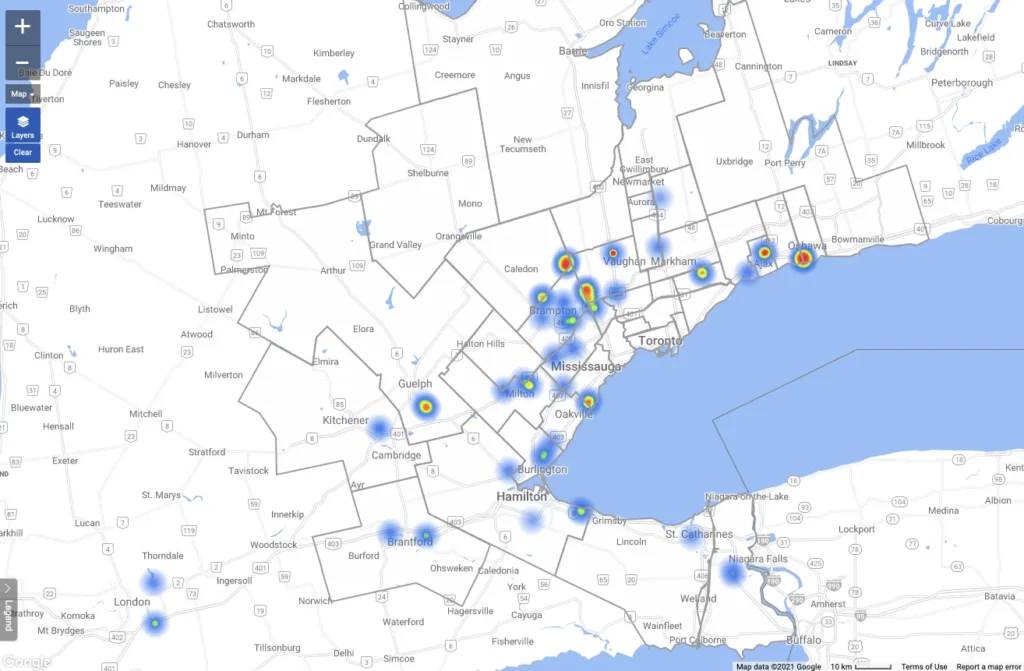

As is evident in Figure 4, the majority of industrial projects under construction are in the periphery of the City; with known hot-spots in Caledon, Brampton, Mississauga, Milton, Vaughan, Guelph, Hamilton, Kitchener-Waterloo, Oshawa, and Ajax. The majority of these projects come directly as a result of the boom in e-commerce. Namely, they are predominantly ‘Big Box’ distribution centres that have been pre-leased to logistics, transportation, e-commerce, or food companies.

Fig-4: Industrial Projects Under Construction – Source: CoStar

Let’s quickly bring back a point we made earlier. Despite delays in construction due to ongoing labour and material shortages, health and safety protocols, and extended permitting processes, the current development pipeline far outstrips pre-2018 levels (Figure 3).

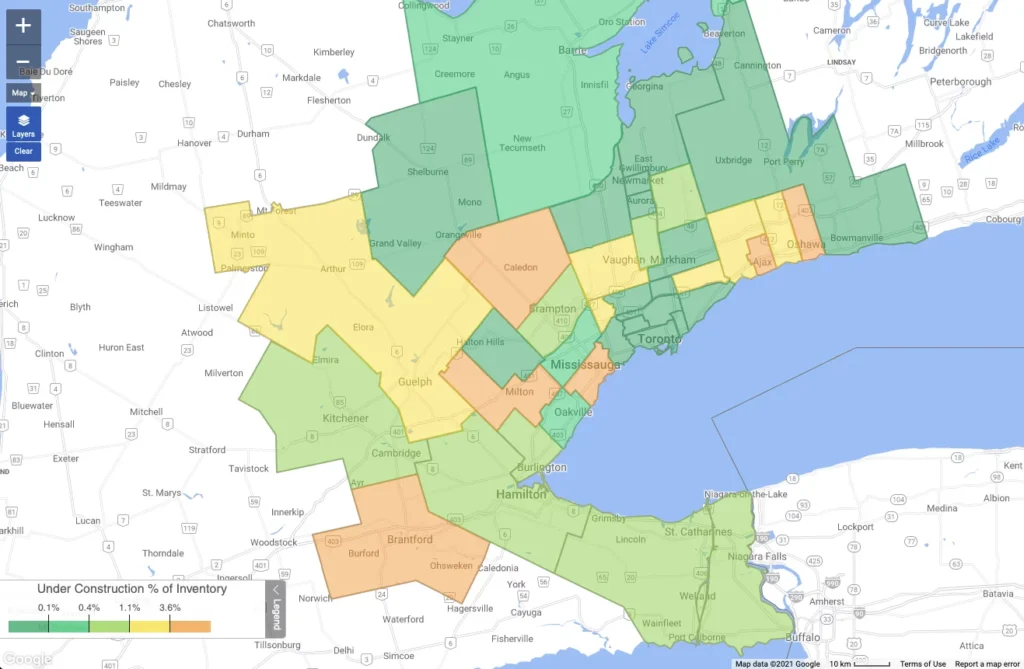

Now, take that fact in context with Figure 5 and we can get a clearer picture as to why the GTA is experiencing a chronic shortage. Few submarkets have pipelines that constitute more than 3.6% of existing inventory, with the notable exceptions being Milton, Caledon, South Mississauga, Brantford, Ajax, and Oshawa. And about half of the submarkets are building less than 1% of inventory.

Fig-5: Industrial Projects Under Construction as % of Inventory – Source: CoStar

Figure 6 shows forecasted deliveries over the next 5 years. Fortunately, 2021 will see close to 10 million square feet of new product, however, we should expect to see 2022 slowdown significantly as a lagging effect of 2020.

Moving forward, deliveries are expected to taper off until and unless developers are able to push new projects through the permitting process. Finally, depending on the submarket and year, up to 75% of new deliveries are already pre-leased. For businesses relying heavily on industrial space, looking early and often remains critical to continuity of operations.

Fig-6: New Deliveries (Million SF) – Historical and Forecast – Source: CoStar

Summary

Overall, land has become scarce and expensive, meaning that finding industrial space to purchase, lease, or develop will only become more difficult. Businesses that occupy industrial space that are looking to renew or relocate in the Greater Toronto Area should be aware of the dramatic shift that is and has taken place over the past five years. Every real-estate professional will tell you a similar story about sky-high rents, ballooning costs, and limited available space. However, every time a company looks to conduct a lease or make an acquisition is an opportunity to manage these costs.

Utilizing the right strategic approach can allow for seemingly small and incremental gains which can make for meaningful outcomes on the balance sheet and the long-term profitability of the business. Given the uncertainty and competitiveness of the broader market, it may be vital to engage with an industrial team early and often throughout the process to receive feedback, as well as proceed with time-sensitive opportunities.

On that note, if you would guidance on your next renewal, relocation, or renegotiation, or for access to off-market opportunities, please contact our team today.