GTA Small-Bay Industrial Market Update: 2025 Report

August 14, 2025

The Greater Toronto Area (GTA) market continues to attract significant investor interest, driven by limited supply, rising demand from e-commerce, and a growing shift towards specialized ownership structures.

MACROECONOMIC FACTORS

Frequent and unpredictable tariff policy shifts have heightened economic uncertainty in Ontario, as evidenced by a sharp uptick in industrial sublease availability, a critical leading indicator of future market trends. In April 2025, Ontario’s manufacturing sector experienced its steepest monthly employment decline since the pandemic, erasing nearly 33,000 jobs and driving the provincial unemployment rate to 7.8%.

MARKET DYNAMICS

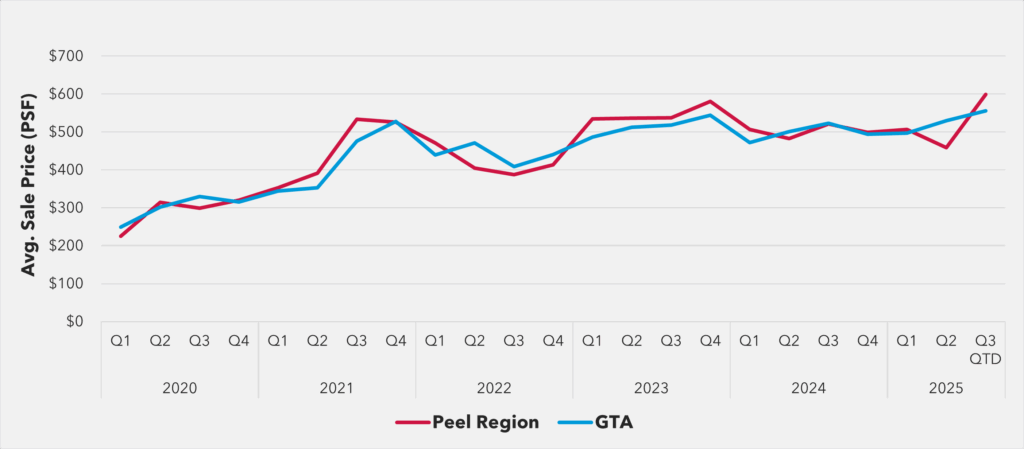

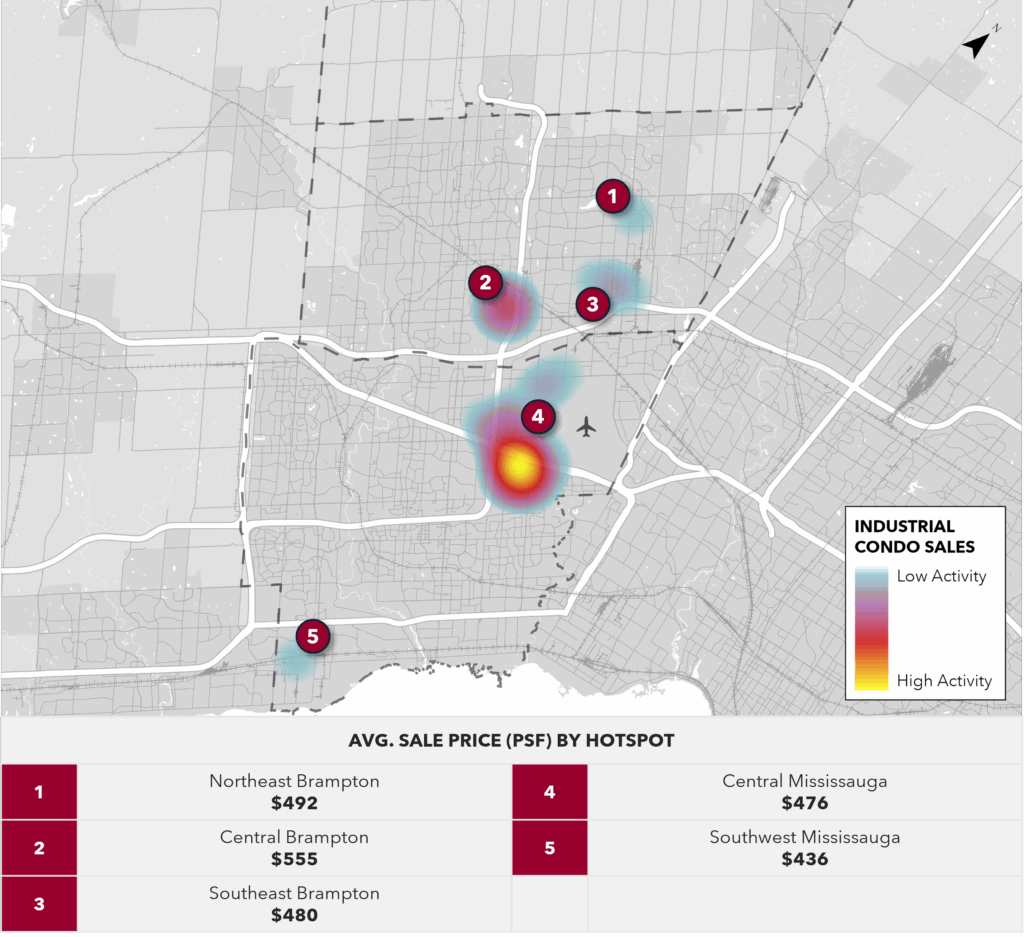

Despite economic headwinds, the industrial condo market in Peel Region has demonstrated strong price stability, with average sales values holding approximately at $488 per square foot (PSF). Brampton units continue to command a notable premium, averaging $520 PSF, compared to $473 PSF in Mississauga. The average industrial condo unit measured 2,400 SF, with 17’ clear heights and 70/30 warehouse-to-office ratios.

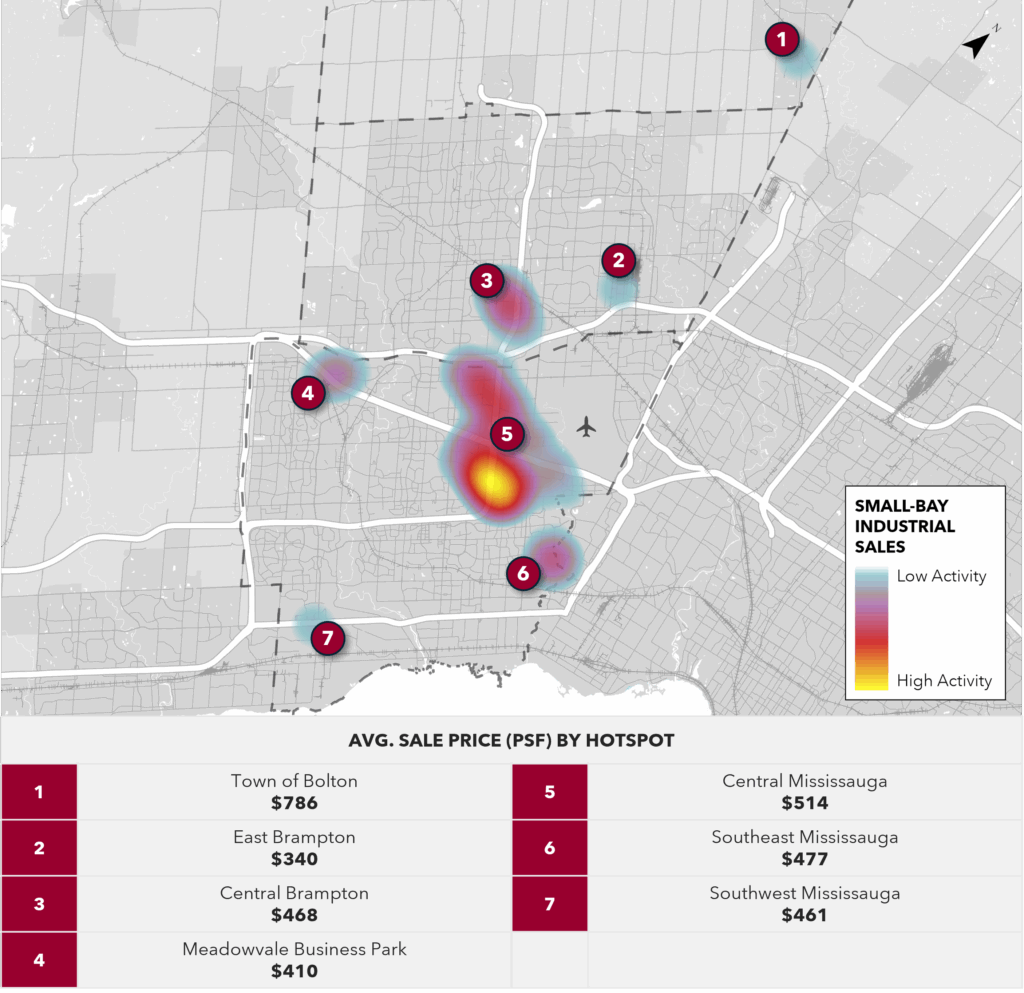

Meanwhile, small-bay industrial properties have also shown price resilience, averaging $470 PSF across Peel, with prices averaging $489 in Mississauga, and $454 in Brampton. These properties average 27,397 SF, with 19’ clear height, and maintained a 75/25 warehouse-to-office configuration. These small-bay properties have attracted growing interest from investors seeking to convert these spaces into smaller industrial condo units, making them optimal for logistics or light manufacturing operations.

INDUSTRIAL CONDO SALE PRICES – PEEL REGION VS GTA

PEEL REGION HOTSPOTS: INDUSTRIAL CONDO SALES

PEEL REGION HOTSPOTS: SMALL-BAY INDUSTRIAL PROPERTY SALES

SALES INSIGHTS

Clear height remains positively correlated with PSF pricing; however, the strength of this relationship varies by location and unique property characteristics

Drive-in doors command a notable premium, highlighting the preferences for operational efficiency

Higher warehouse-to-office ratios correlate negatively with PSF, reflecting the preferences for balanced flex configurations that integrate office amenities along with warehouse space

FUTURE OUTLOOK

Looking ahead, Canada’s industrial condo and small-bay sector is poised to enter a compelling growth phase, driven by persistent undersupply and local demand. The demand fundamentals remain robust and highly diversified, accommodating a range of businesses from light manufacturing and trades to last-mile e-commerce hubs, all of which are strongly influenced by favourable demographic trends such as Canada’s population growth. This underlying resilience continues to sustain notably low vacancy rates, outperforming larger industrial asset classes.

Contact our expert:

Zade Dwaik

Senior Associate

Sales Representative

D: (416) 628-3520

M: (647) 389-4614