GTA Industrial Condo Market Update: 2024 Report & 2025 Outlook

February 3, 2025

Lee & Associates is a leading corporate real estate advisory, brokerage, and management services firm. We deliver exceptional intelligence and expertise across industrial, office, retail, land, and investment sectors, ensuring tailored solutions that meet the unique needs of our corporate clients, partners and investors.

In 2024, the Greater Toronto Area (GTA) industrial condominium market exhibited a mix of rising availability rates, declining rental rates, and significant leasing activity, indicating a shift towards a more balanced market.

MARKET PERFORMANCE

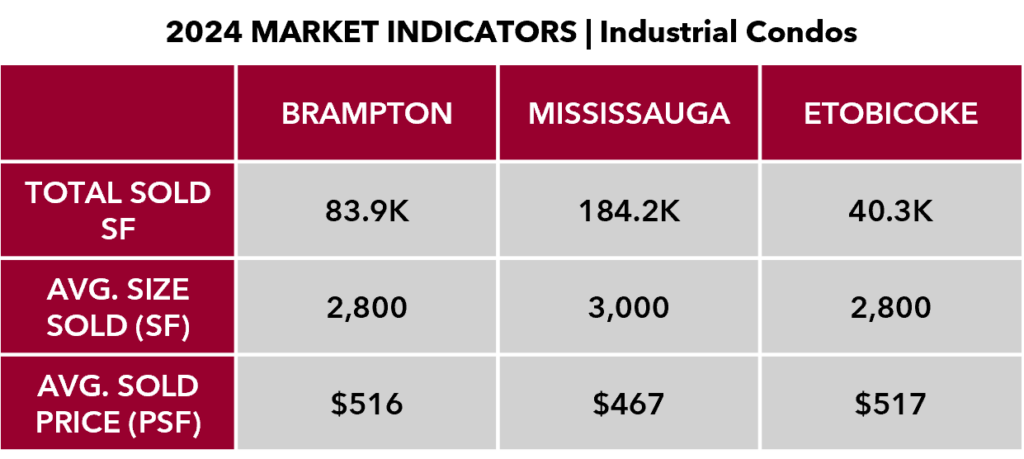

The rising interest rate environment exerted downward pressure on sale prices, softening them and creating more favorable conditions for buyers and tenants seeking space. Average sales prices hovered around $470 per square foot, with highs in the mid-$500s, marking a notable decline of approximately 15% from the 2022 peak. Despite this decline, prices held relatively firm due to the persistent lack of supply, which continued to act as a buffer against further depreciation.

DYNAMICSThe softened pricing environment signaled a shift in the balance of power, empowering buyers with more negotiation leverage while also providing opportunities for tenants to secure space at adjusted pricing levels. Small bay condominiums, often sought after for their flexibility and suitability for a range of uses, continued to see demand, albeit at a moderated pace, as higher borrowing costs impacted purchasing power.

|

2025 OUTLOOKLooking ahead to 2025, the market is expected to continue adjusting under the influence of macroeconomic factors, including interest rate cuts by the Bank of Canada aimed at stimulating economic activity. Lower borrowing costs could boost investment in industrial properties and ease financing challenges for businesses, potentially stabilizing demand and fostering leasing and purchasing activity. However, the elevated availability and increased sublease space from 2024 suggest that tenants will retain bargaining power in the short term, and rental rates may remain subdued, especially with additional supply entering the market. Despite these near-term challenges, the GTA industrial market’s fundamentals remain strong, supported by sustained demand from e-commerce, logistics, and manufacturing sectors. Rate cuts may provide an opportunity for businesses to secure industrial space under favorable conditions, paving the way for gradual recovery and market stabilization by mid to late 2025. |

Overall, 2025 is likely to be a transitional year, marked by tenant-friendly conditions, steadying rental rates, and optimism for long-term growth.