GREATER GOLDEN HORSESHOE: THE NEXT FRONTIER

February 24, 2022

Greater Golden Horseshoe: The Next Frontier

Over the past decade, the Greater Toronto industrial market has seen a remarkable transformation – a reflection of the city’s coming-of-age into a global metropolis. Coupled with the rise of e-commerce, industrial rents and values have approximately doubled over the last five years – and continue to rise – while space is increasingly difficult to find.

A market that was once relatively inexpensive, even undervalued by some analysts, has crowded out investors and occupiers due to intense competition. For retailers and third-party logistics businesses, trying to line up opportunities with growth forecasts has made it challenging to execute their real estate strategy in a timely manner.

As a result, these dynamics have pushed both investors and occupiers to look further out, with many identifying the Greater Golden Horseshoe as the next frontier. Located just over an hour West of the City’s industrial core, the region provides a potentially cost-effective alternative with ample access to labour and development options.

We predict this trend will continue – with the spillover effect quickly increasing industrial rents and values, albeit to a lesser degree than within the GTA.

With that said, let us examine the state of the Greater Golden Horseshoe logistics market, and see what story the data can tell us regarding costs, recent transactions, and future opportunities.

GTA West Logistics Facility Leasing – 2016 to 2021 Key Metrics for GGH Logistics over 50k SF

- Rents: $9.14 PSF (+9.8% Year over Year)

- Vacancy: 0.8% (-1.1% from 1 Year Ago)

- Inventory: 74.2 million SF (+1.0% Year over Year)

- 12-month net deliveries: 731,832 SF

- 12-month net absorption: 1.5 million SF

- Under construction: 546,000 SF (-55.3% Year over Year)

- Market sale price: $118 PSF (+16.8% Year over Year)

- Cap rate: 6.3% (-0.1% from 1 Year Ago)

Observing the key metrics above, we see a tightening of the GGH logistics market – with rents and values increasing significantly over the past year. We can attribute this pattern to two main drivers:

First, the general insatiable appetite for logistics space by retailers and 3PLs has created a ‘rising tide’ in rents and values while pushing down availabilities.

Second, the relative cost and difficulty in securing space in the neighbouring Greater Toronto markets has pushed many investors and businesses, alike, to the Greater Golden Horsehoe markets of Hamilton, Kitchener, Cambridge, Waterloo, Brantford, and Guelph. Both factors have resulted in a significant imbalance between absorption and net new deliveries, meaning we can expect further constraints in the months and years ahead.

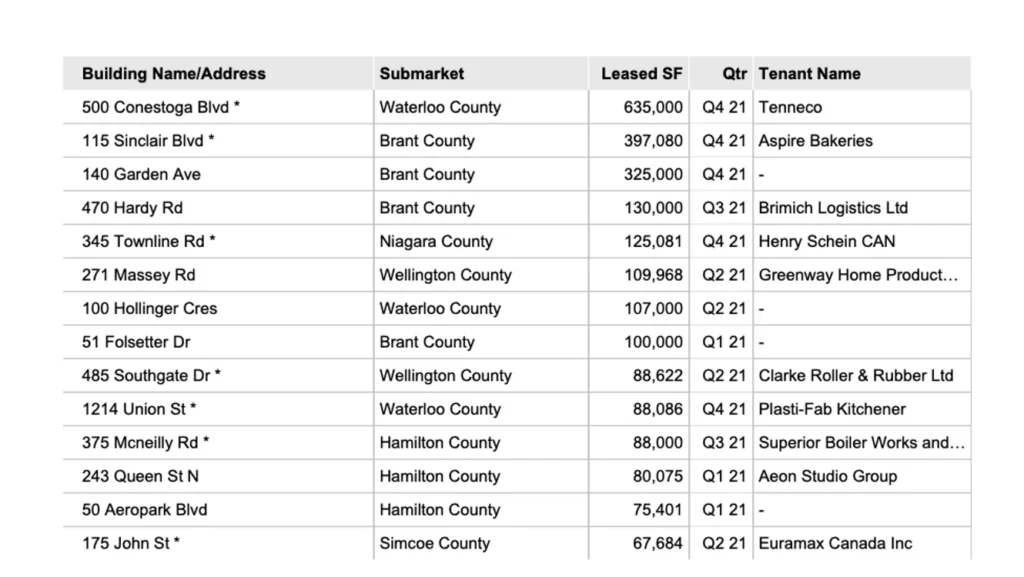

Notable GGH Industrial Leasing Transactions

Figure 1 captures the top industrial leasing transactions by size across the GGH over the past 12 months. Unlike the GTA, whose top industrial transactions are largely comprised of retailers and 3PLs, we see a more diverse mix of industrial users taking space in the Greater Golden Horseshoe area.

Figure 1: Top 14 Leasing Transaction from Past 12 Months. Source: CoStar.

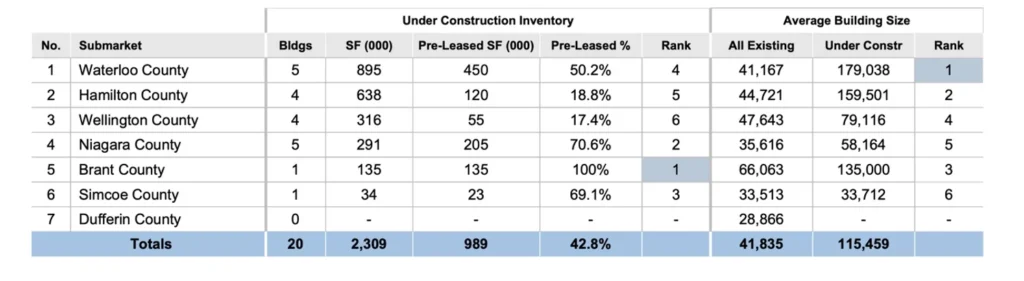

GGH Logistics Pipeline of New Construction

Complementing the table above, Figure 2 outlines new industrial construction by submarket. Some important takeaways:

- The average size of new construction (115,459 SF) is head and shoulders above the average size of all existing industrial properties (41,835).

- Approximately 989,000 SF out of 2.3M SF – or 43% of new construction – has been pre-leased, with the balance likely in the process of being secured.

- Hamilton and Wellington (Guelph) Counties lead the way in terms of available space under construction (a combined approximate 779,000 SF), while Brant County is fully pre-leased (according to existing data).

- Given the relative availability of developable land, as well as the growing appetite in the region, we expect the volume of new projects to pick up in the coming years.

In our study, we found average rents increased from $6.13 in 2016 to $11.34 in 2021, and ranged from $4.25 PSF net to $14.75 PSF net. The average amount of space increased from 126,451 SF in 2016 to 167,301 SF in 2021, and ranged from 50,000 SF to 774,614 SF.

The data confirms the typical understanding that industrial rents are moving towards the $12 to $14 PSF-net-range and up, depending on the location, size and overall quality of the asset. It has also shown us the preference towards larger facilities that accommodate growing logistics space needs.

Figure 2: GGH Industrial Construction by Submarket. Source: CoStar.

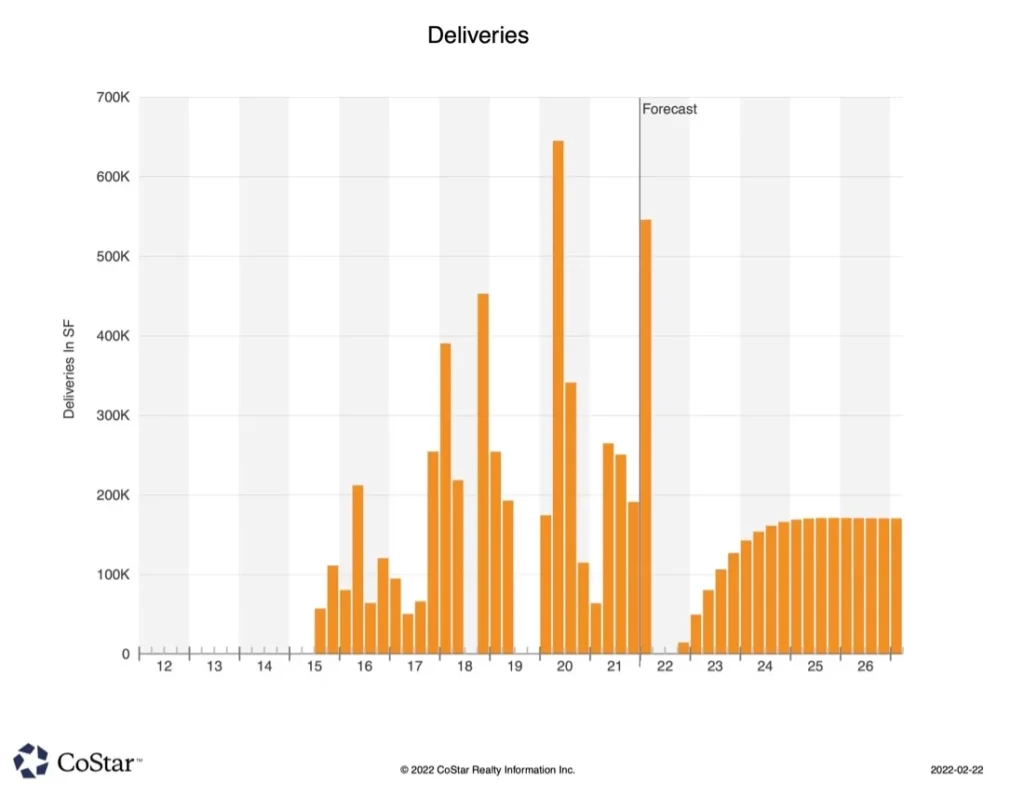

Finally, Figure 3 depicts historical and forecast data for new deliveries. As new entrants to the region increases and developers work to meet demand, we expect to see more development in 2023 and beyond.

Figure 3: Historical and Forecast GGH Industrial Deliveries. Source: CoStar.

Summary

Overall, the GTA industrial logistics market is red-hot, with all-time-low availabilities and supply challenges. This environment will see businesses looking to fulfil their growth plans by considering cost-effective options within the Greater Golden Horseshoe area.

As the e-commerce and logistics industry experiences greater growth in 2022 and into 2023, meeting your space needs may require additional planning and foresight, as well as being willing to pay a premium for quality space.

Your best strategy will be to open a dialogue with a commercial real estate broker at the earliest indication that space will be needed.

On that note, if you would like our team to assist with your next lease, or for more market intel or off-market opportunities, please contact us directly.