7 FACTORS DRIVING DEMAND FOR LOGISTICS REAL ESTATE

September 23, 2021

7 Factors Driving Demand for Logistics Real Estate

As we head into fall, we find ourselves in what is historically the busiest season for commercial real estate transactions. Wedged between two holiday seasons and leading up to the fiscal year-end, businesses with active requirements and needs for space have a great runway to secure new facilities; whether it be through a renewal, new headlease, or purchase.

Given the Greater Toronto Area’s desirability, the demand from tenants has never been more robust, especially since the meteoric rise of e-commerce. Furthermore, the lackluster performance of alternative asset classes has led to a divestiture and pivoting by many investors – private and institutional alike – towards industrial properties and land.

Taken together, it has created a severely imbalanced market with overheated demand, and where supply has been further hamstrung by increasing costs and delays in construction. As a result, rental rates and valuations continue to set new benchmarks with each new deal.

So, with that foundation laid, let’s take a look at some of the drivers and trends moving the logistics and e-commerce sector.

So Which Trends are Behind the Explosive Demand for Logistics Space?

1. Completed leases exceed asking rents due to explosive demand

As a result of the red-hot demand, industrial rents for properties over 100,000 square feet have increased 11.3% year-over-year to an average of $12.07 per square foot net; with asking rents sitting at an average of $9.60 per square foot net.

2. Economic shutdown supercharged online sales volumes

According to Bloomberg, Canadians are forecast to spend $92.7 billion online by 25, more than double the $44.7 billion of e-commerce goods purchased in 2019. Prologis estimates that each $1 billion increase in online shopping will translate to a need for 1.2 million square feet of warehousing and distribution space. This means the pandemic-related shutdowns will drive a need for an additional 57.6 million square feet of space over the next 5 years.

3. Industrial land has become astronomically expensive due to scarcity

Industrial land values continue to set records, with desirable sites fetching north of $3 million per acre in certain submarkets. Delays in the permitting, zoning, and servicing processes, as well as increases in development charges by municipalities is exacerbating the issue of lack of supply. Along with dramatic increases in materials and labour – when it’s all said and done – developers will pass these cost increases along in the form of higher rents and sales prices.

4. The revolution in retail has trickled down to industrial

Amazon sold over 12.6 billion items in 2020. In response, it opened 28 sorting centers, 59 delivery stations, and 65 Prime Now hubs across the United States. This activity is similarly strong in Canada, with the e-commerce behemoth working at a lightning-quick pace to build out its distribution network, not only for itself, but for other retailers as it expands into the 3PL market.

5. E-Commerce giants set the pace for logistics and warehousing appetite

Amazon, Walmart, eBay, Apple, and BestBuy are the top 5 online retailers as of Q3 2021. They continue to set the pace in the market, taking up enormous swaths of incoming supply. The ‘Amazon effect’ has created a rising tide of rents and valuations while keeping supply constrained.

6. Last-mile’ challenge turns focus towards in-fill redevelopment

As online retailers and logistics companies have largely established periphery locations to handle regional needs, they will turn towards urban in-fill redevelopment to get closer to consumers; effectively closing the loop on the supply chain. This will lead to increased demand for industrial properties within the City’s core markets as they work towards goals of one-hour delivery times.

7. Different ‘last-mile’ solutions mean differing real estate needs

Diving deeper into last-mile supply chains, it should be noted that each company may have different definitions and approaches to the problem, meaning their solutions may also differ in execution. While Amazon works to build out a distribution network that has never previously existed, some established retailers, such as WalMart, are leveraging existing retail locations to double up as ‘ship-from-store’ distribution hubs.

Summary

The GTA industrial market is seeing watermark rental rates and valuations with each passing transaction. This phenomenon is being led by both expanding e-commerce footprints and new entrants into the market, as well as 3PLs and retailers making their supply chains more robust, and the growing food and beverage industries.

Due to these factors, as well as the scarcity of industrial real estate and the efficiencies that come along with scale, the average square footage of requirements are increasing. For proof of this, one need only look at the plethora of both completed transactions and known requirements for facilities over 400,000 square feet. Moving into the balance of 2021, we are seeing an interest by businesses, investors, and developers towards in-fill redevelopment within the City core, justified by rising rents and to cover ‘last-mile’ needs.

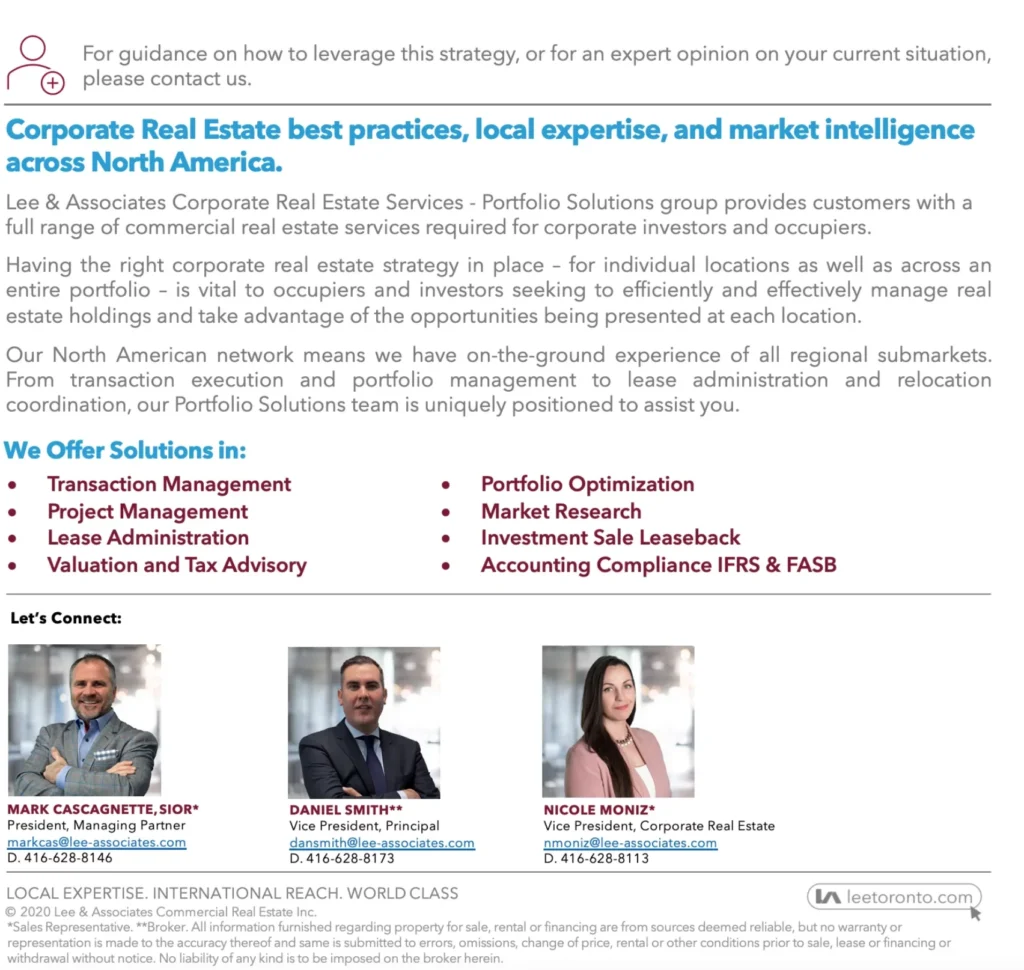

On that note, if you would like our team to assist with your next lease or purchase, or for more market intel or off-market opportunities, please contact us directly.