LOOKING TO RENEW OR RELOCATE? HERE’S WHAT YOU NEED TO KNOW

July 2, 2021

A Detailed Analysis of the GTA Industrial Market – Renew or Relocate?

For those businesses dependent on industrial space to manage their operations, waking up to the realization that you may be facing a steep hike in your rent can create mild panic. That’s because setting up shop comes with a significant up-front investment in machinery, equipment, people, as well as getting the business off the ground and into a rhythm. These costs are often built into the company’s operating model and spread out over several years. However, over the past decade, rental rates have – in some cases – more than doubled in certain submarkets and for facilities with certain sought-after features, such as clear heights, location, and shipping. Businesses with 10-year leases coming due are often unaware of the steady but sudden shift that has taken place. This problem, therefore, may pose a threat to the long-term profitability of many occupiers.

Your first reaction may be to take a step back and get a second opinion from another landlord or real estate professional, however, you would likely see that the situation is consistent across the board. You may then consider purchasing a building to fix your real estate costs, although, the pickings are slim thanks to the uber-competitive ecosystem of private landlords and institutional investors.

Finally, you may concede and decide to relocate. But again, this can only bring about a similar outcome with the added expense of moving. So, what is one to do? Well, after successfully navigating this situation for a wide range of clients over the past few decades, Lee & Associates Toronto’s Industrial practice can offer you and your team the strategy and guidance to find the path of least complexity and overall cost management. Pricing today is only going up, but even a number of small strategic wins can result in significant cost savings – from hundreds of thousands up to millions of dollars – over the lifetime of your lease or acquisition.

So, with that said, let us examine the Greater Toronto Industrial market from a 40,000-foot view to see where there may be future opportunities and potholes to watch out for.

Insatiable Demand Drives Strong Sales

It has now been complete ingrained in the commercial real estate market’s psyche that industrial reigns supreme. Even before the pandemic kicked it into overdrive, investors took a liking to the strong fundamentals and predictable cashflows. Developing ‘Big Box’ warehouses or small- to medium-sized manufacturing shops were less complicated than high-rise residential towers. And with a high-covenant Tenant in hand, it was almost impossible to fail.

Then, as soon as e-commerce came onto the scene, it was clear that all of the tangential sectors – from warehousing to logistics and transportation to cold storage – would directly and indirectly rely on industrial space to make their businesses run. Demand skyrocketed. And the rest of the story wrote itself.

Fig-1: Sales Volume & Market Sale Price Per SF – Source: CoStar

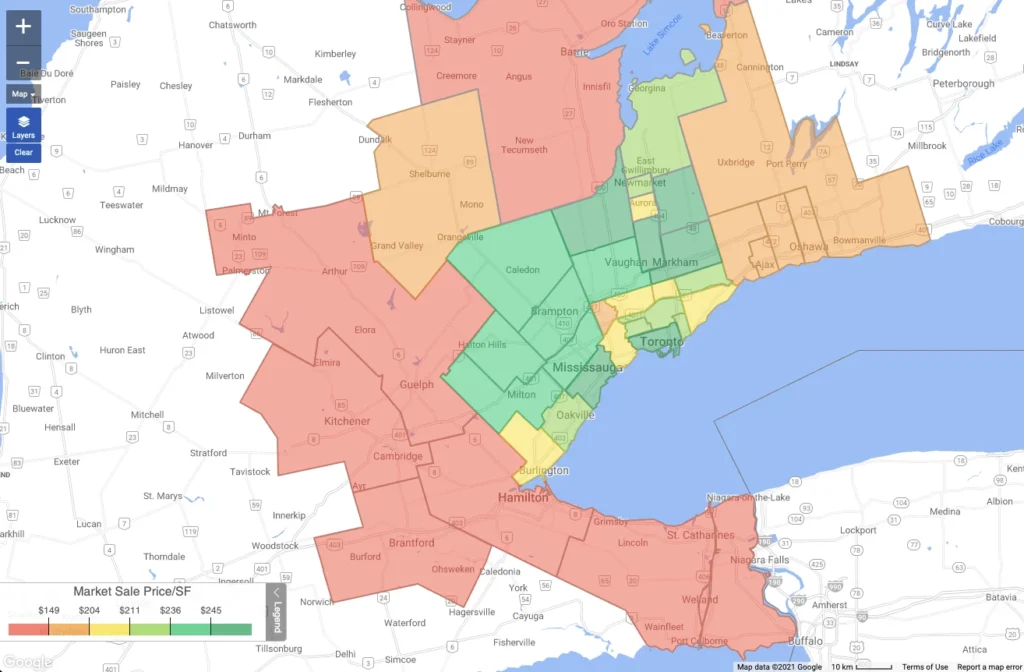

As we can see below in Figure 2, the core Central, North, and West markets lead the way in terms of sales pricing. This can be attributed largely to ‘location, location, location.’ Further, the majority of the population tends to live in proximity to the City’s Core, its public transit, and its transportation routes; a necessity for both the labour pool and the movement of goods. However, the East and outlying markets are still considered value plays, with some developers, investors, and tenants considering venturing outside the more ‘traditional’ industrial pockets.

Fig-2: Market Sales Price/SF – Source: CoStar

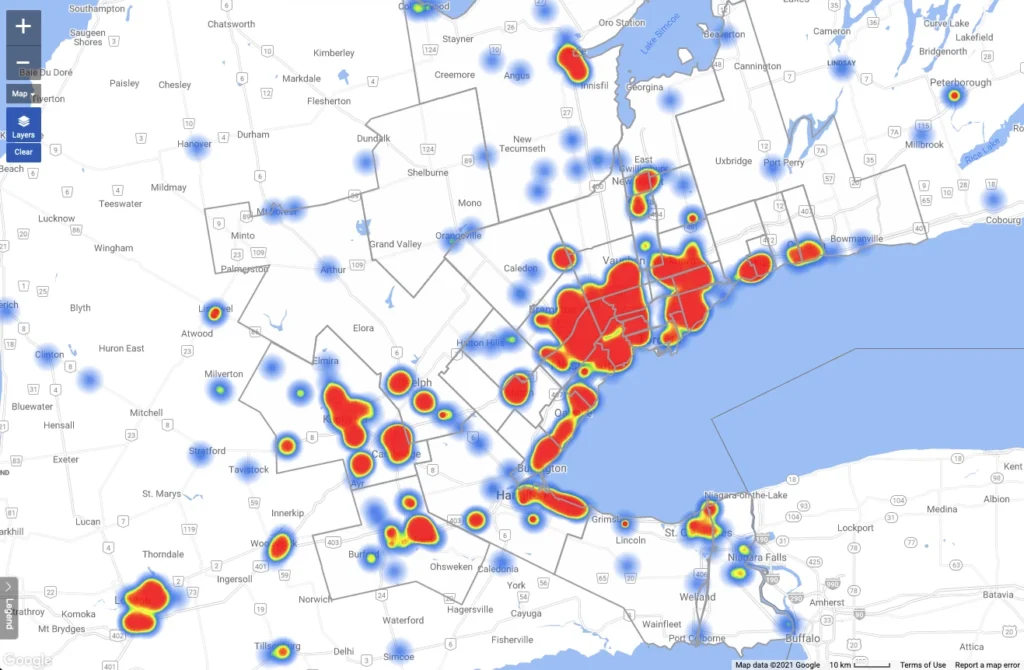

Figure 3 shows the 12-month GTA industrial sales volume activity. Although much of the transactions occurred in expected territories, we can also see trades happening in the East and Western outlying markets such as Kitchener-Waterloo, Guelph, and Hamilton.

Fig-3: 12-Month Sales Volume – Source: CoStar

Rents are How Much?

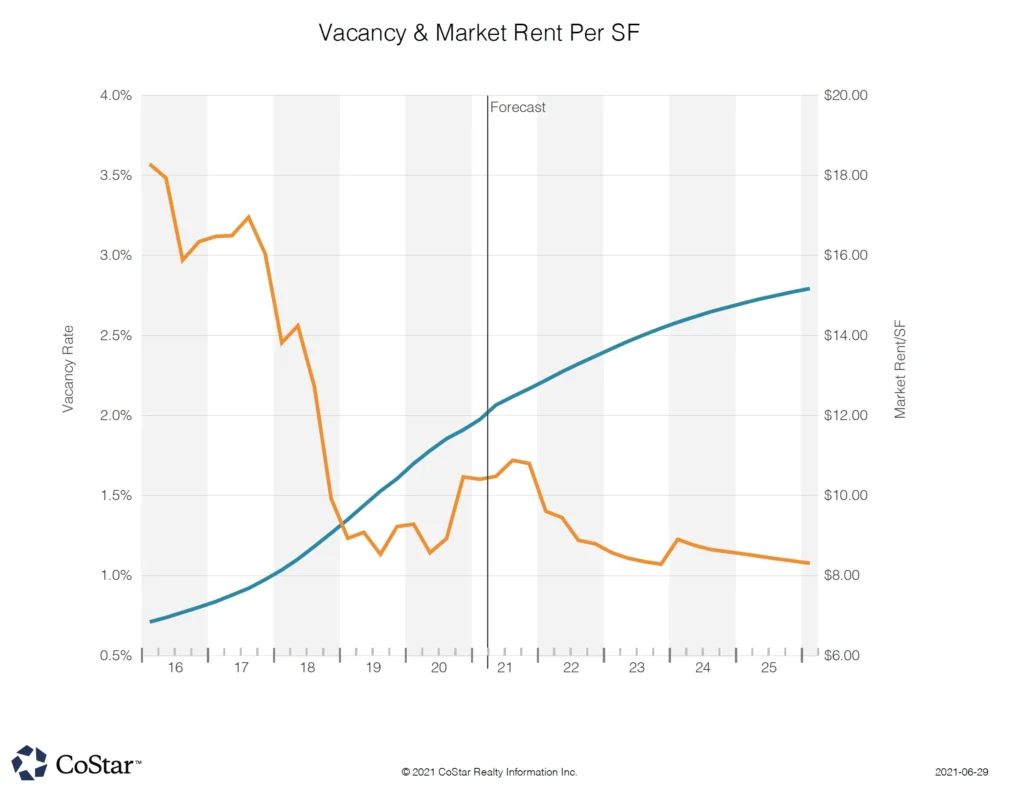

As we alluded to earlier, the explosive demand for industrial space in general has taken the market by surprise. Developers are working full-speed to bring relief in the form of new supply, however, a large percentage of new construction is already pre-leased. Companies unable to wait two to three years (or more) are tapping into direct availabilities, which have dropped steadily over the past 5 years from 3.6% down to a range where it hovers anywhere between 1% to 1.5%. For specialty facilities in certain submarkets, availabilities can reach as low as 0.1%. Due to the simple supply and demand dynamic, competition has pushed rental rates from approximately $7.00 per SF net in 2017 to over $12.00 per SF net in 2021, and forecasted to hit $14.00 per SF net by mid-2023.

Fig-4: Vacancy & Market Rent Per SF – Source: CoStar

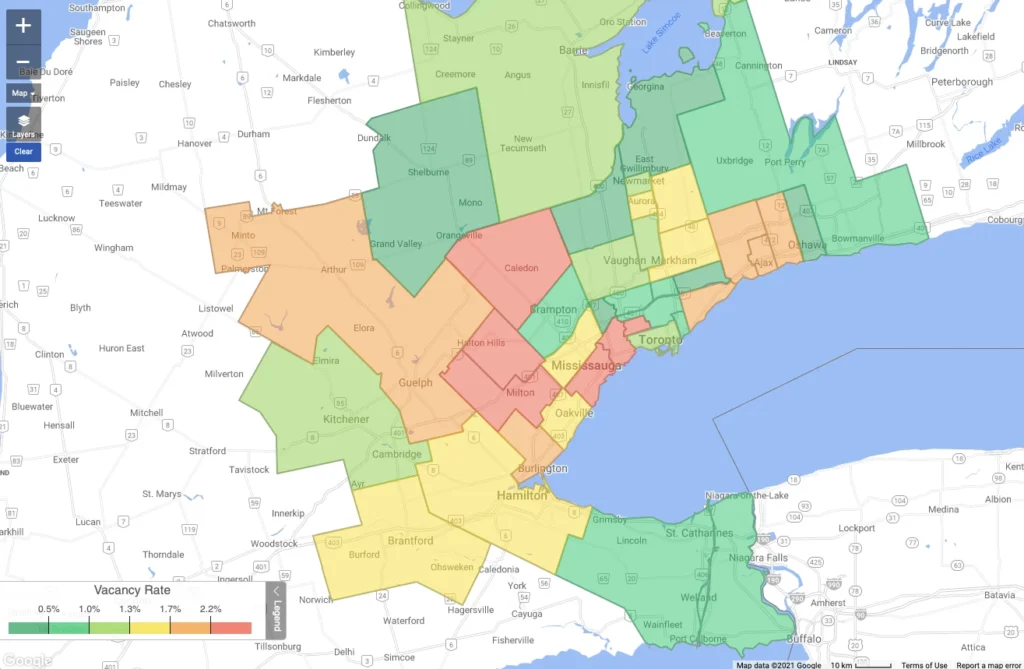

As is show in Figure 5, almost all GTA Industrial sub-markets have sub-2% vacancies, with many key areas at sub-1%.

Fig-5: Vacancy Rates – Source: CoStar

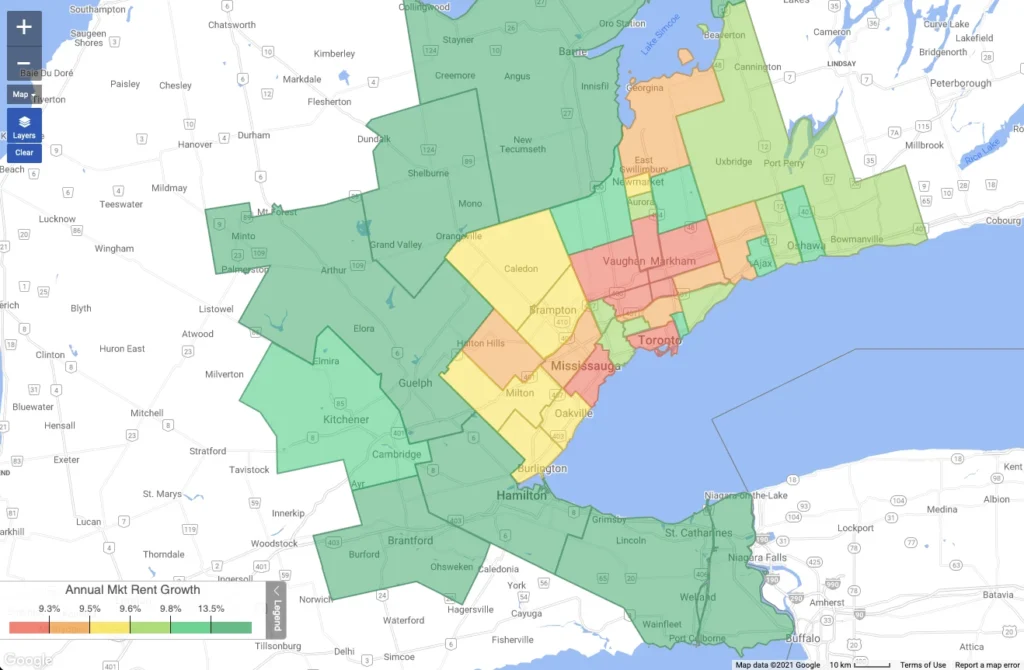

As businesses shop around for value, we see rents in the outlying markets outpacing that of the Core. However, let us not forget the scale of these increases. Every sub-market depicted in Figure 6 has industrial rental rates growing at a minimum of 9% year-over-year to over 13.5% year-over-year. Therefore, we can infer that the outlying markets are simply playing catch-up.

Fig-6: Annual Market Rent Growth – Source: CoStar

Summary

Overall, businesses that occupy industrial space who are looking to renew or relocate in the Greater Toronto Area should be aware of the dramatic shift that is and has taken place over the past five years. Every real-estate professional will tell you a similar story about sky-high rents, ballooning costs, and limited available space. However, every time a company looks to conduct a lease or make an acquisition is an opportunity to manage these costs.

Utilizing the right strategic approach can allow for seemingly small and incremental gains which can make for meaningful outcomes on the balance sheet and the long-term profitability of the business. Given the uncertainty and competitiveness of the broader market, it may be vital to engage with an industrial team early and often throughout the process to receive feedback, as well as proceed with time-sensitive opportunities.

On that note, if you would guidance on your next renewal, relocation, or renegotiation, or for access to off-market opportunities, please contact our team today.