LEASING ACCELERATION IN GREATER TORONTO AREA WEST MARKETS

February 10, 2022

Leasing Acceleration in Greater Toronto Area West Markets

Just as most e-commerce businesses have been overwhelmed by the explosive growth of online sales and its effects on their operations, so has the industrial real estate market been affected by skyrocketing demand.

Because of the sudden shift towards purchasing goods and services on the internet these past 2 years, any pre-existing inventory has been quickly absorbed. Since then, the industrial market has been struggling to meet the needs of third-party logistics firms and online retailers.

Put simply, investors and developers simply cannot construct facilities quickly enough, no matter that tens of millions of square feet are under development across the GTA, nor that billions of dollars are being committed to these initiatives.

All of these headwinds have translated into greater competition for space, as well as rapidly increasing rents.

Over the past several weeks, we have highlighted the sales and leasing activity of logistics facilities across the Greater Toronto Area.

In the coming issues, we would like to examine the acceleration of leasing rates in various GTA market clusters. This week, we will look at leasing transactions in the GTA-West markets over the past 6 years, as well as what we expect for 2022 as it relates to supply, rents, and new inventory.

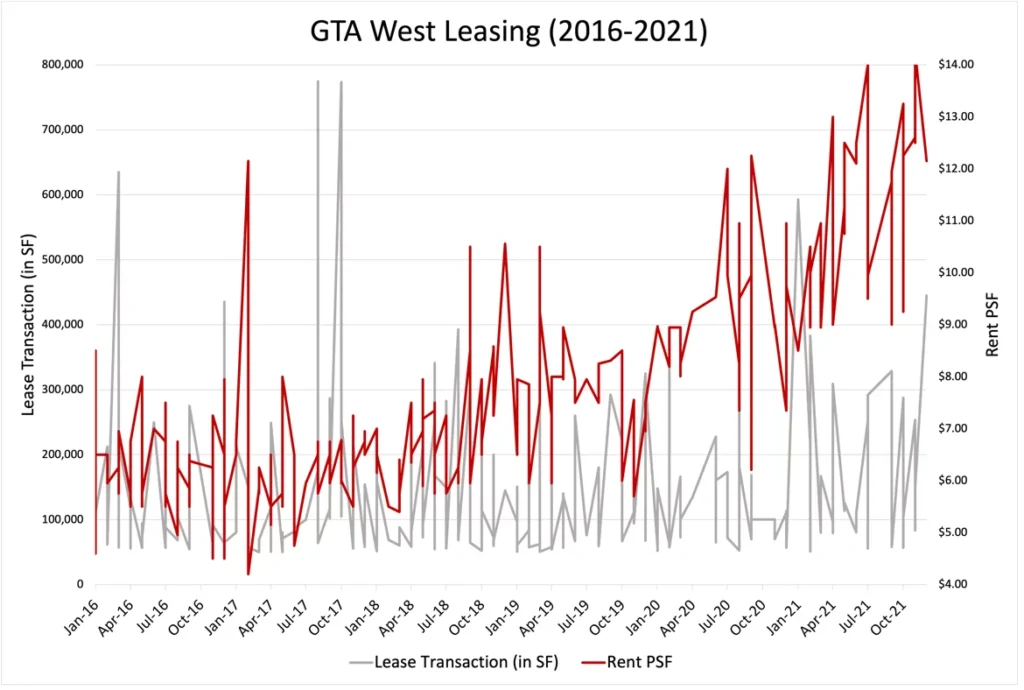

GTA West Logistics Facility Leasing – 2016 to 2021

Below in Figure 1, we put together a visual representation of leasing transactions of logistics facilities over 50,000 SF that took place from 2016 to 2021 in the GTA-West markets.

Our dataset consisted of over 250 transactions in the Mississauga, Brampton, Burlington, Milton, Oakville, Halton Hills, and Caledon submarkets.

Figure 1: 2016-2021 Leasing of GTA-West Logistics Facilities Over 50k. Source: CoStar.

Note: Leasing data is typically not in the public record, and therefore, our analysis is limited to properties and deals where data is available. In general, because of the sensitivity of the information, reported rents tend to be below where the market overall sits, and in some cases, may be below actual rents.

In our study, we found average rents increased from $6.13 in 2016 to $11.34 in 2021, and ranged from $4.25 PSF net to $14.75 PSF net. The average amount of space increased from 126,451 SF in 2016 to 167,301 SF in 2021, and ranged from 50,000 SF to 774,614 SF.

The data confirms the typical understanding that industrial rents are moving towards the $12 to $14 PSF-net-range and up, depending on the location, size and overall quality of the asset. It has also shown us the preference towards larger facilities that accommodate growing logistics space needs.

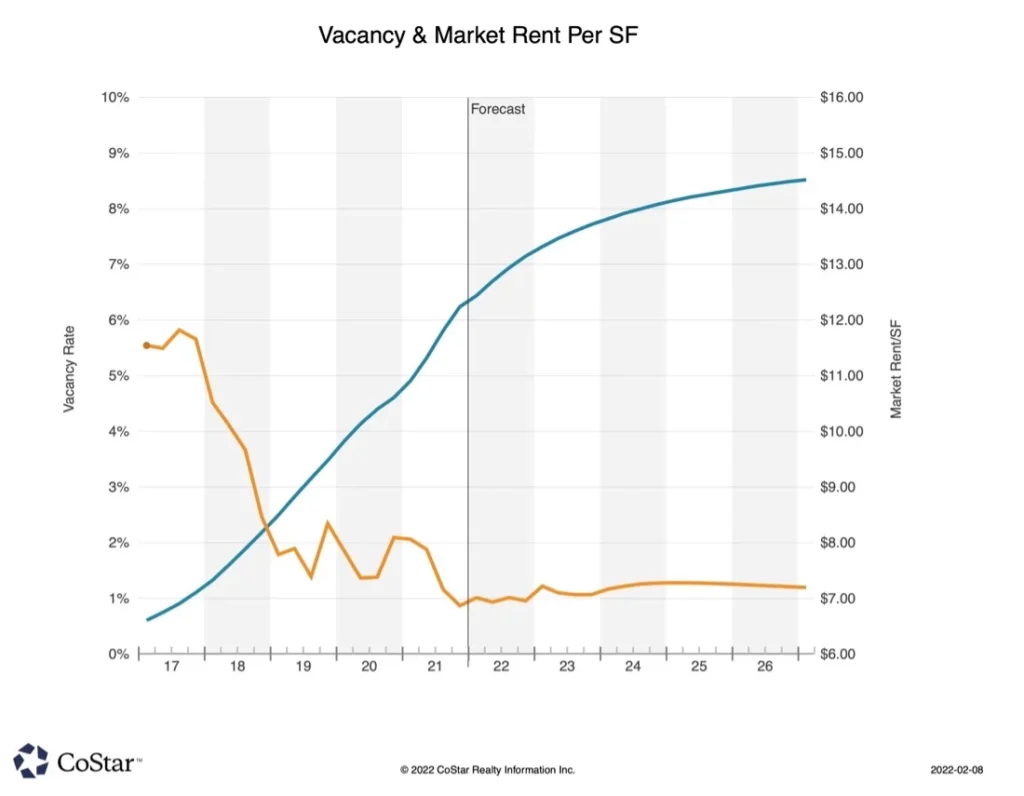

Figure 2: GTA-West Logistics Facilities Over 50k SF- Vacancy & Rents. Source: CoStar.

Looking towards supply in Figure 3, as overall industrial availabilities in the GTA have contracted to just 0.6% in Q4 2021 – and have dipped below 1% for GTA-West Logistics Facilities, as shown in Figure 2 – we expect upward pressure on rents to continue at an accelerated pace.

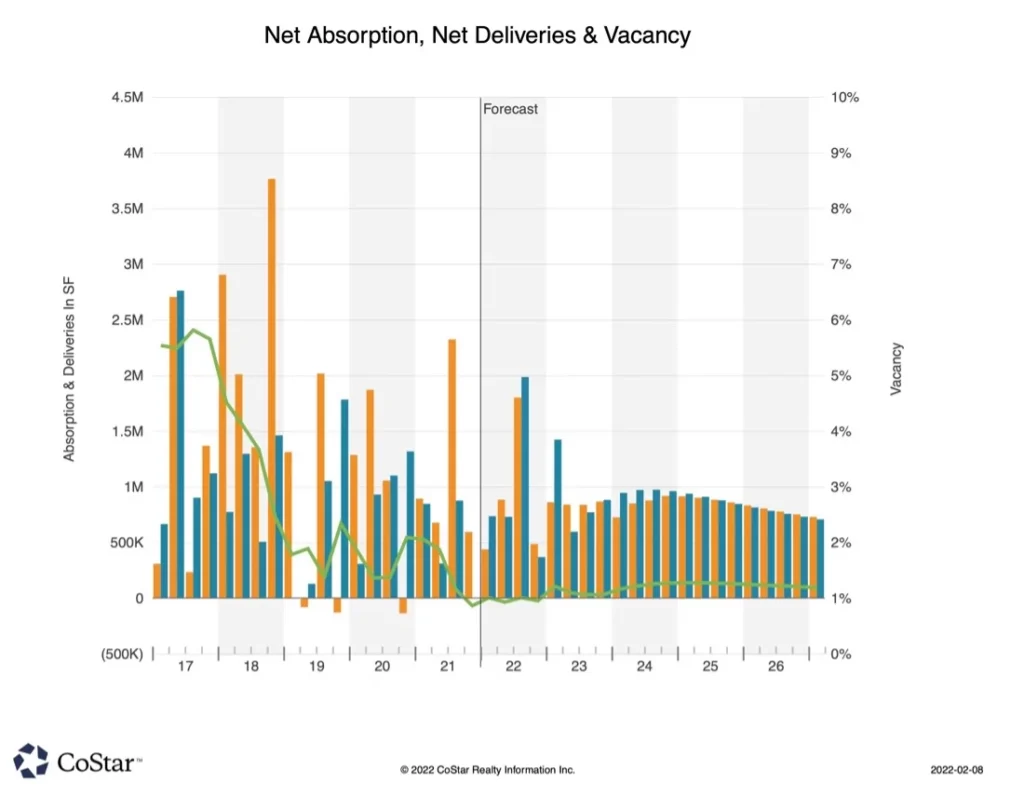

Supply chain issues, coupled with increasing costs to construct, have delayed the delivery of new product. Absorption remains robust, and we do not forecast noticeable relief until 2023.

Figure 3: GTA-West Logistics Facilities Over 50k SF – Net Absorption, Deliveries & Vacancy. Source: CoStar.

Summary

The GTA industrial logistics market is red-hot, with all-time-low availabilities and supply challenges. This environment will see rents further increasing, with new construction providing little relief until at least 2023.

As the e-commerce and logistics industry experiences greater growth in 2022, meeting your space needs may require additional planning and foresight, as well as being willing to pay a premium for quality space.

Your best strategy will be to open a dialogue with a commercial real estate broker at the earliest indication that space will be needed.

On that note, if you would like our team to assist with your next lease, or for more market intel or off-market opportunities, please contact us directly.