LABOUR, LOCATION, LOGISTICS: CRITERIA EVERY BUSINESS SHOULD CONSIDER

July 29, 2021

A Detailed Analysis of the GTA Industrial Market

The Greater Toronto industrial market has exploded in its growth over the past decade, continually reaching new heights and grabbing the attention of professionals across the globe. We profiled the insatiable demand for industrial space and its effect on sales volume, pricing, and rental rates in a previous article. Similarly, we took a deep dive into industrial land and the pipeline of new construction in the second instalment of our series.

The result of our inquiry clearly showed the problems that industrial-focused businesses are facing when renewing a lease, trying to purchase a facility, relocating their operations, or right-sizing their real estate footprint. It also highlighted some of the struggles that institutional and private investors, as well as developers are experiencing when trying to deploy capital or construct properties.

Despite how expensive and scarce industrial space has become, and the difficulty it has created in executing transactions, deals are being completed every day. While timing plays a part, finding the right real estate solution is a matter of diligently tracking the market for opportunity. Chances inevitably present themselves, but they disappear just as quickly as they are revealed. However, diligence and persistence in the process can provide leverage in a negotiation, help secure the ideal facility, and realize significant cost savings, giving your business a boost to its bottom line and future growth potential.

That being said, your search should always begin by getting absolute clarity on what it is you need. So, with that in mind, let’s examine some of the criteria you should consider when looking for industrial space.

General Search Criteria

While not an exhaustive list, below are some of the general search criteria as they pertain to hard costs; a reflection of the state of the market and its various input costs. These are a great starting point when producing an initial survey.

Rental rates: Rapidly increasing beyond $12 per square foot, we examined them in detail here. If rents are a dealbreaker, you should address your situation well in advance of any renewal or hard occupancy date.

Availabilities: Hitting all-time lows, industrial availabilities are hampered by hamstrung supply, which we showed here. Tracking the market and looking for off-market opportunities are your best solutions.

Sales Pricing: A result of booming demand led by e-commerce, pricing continues to go up. If you are waiting for a correction to find a deal, you may be waiting for quite a long time.

Construction Costs: Supply chain shocks and shortages of raw materials and labour have pushed construction costs to record levels. General consensus is that these will come down as relief is provided, however, there is still uncertainty in the near- to medium-term.

Development Charges: These can vary drastically depending on the submarket and the size of the project. In some cases, these charges can dramatically affect the profitability, cap rate, and rental rate required to make the development feasible. Conversely, some municipalities may offer tax incentives on a case-by-case basis.

Land Values: As outlined in depth here, land values are skyrocketing as investors and developers ‘land bank’ while scrambling to bring more industrial supply to market.

Next, we’ll examine some of the ‘soft costs’ associated with site selection.

Finding People to Work

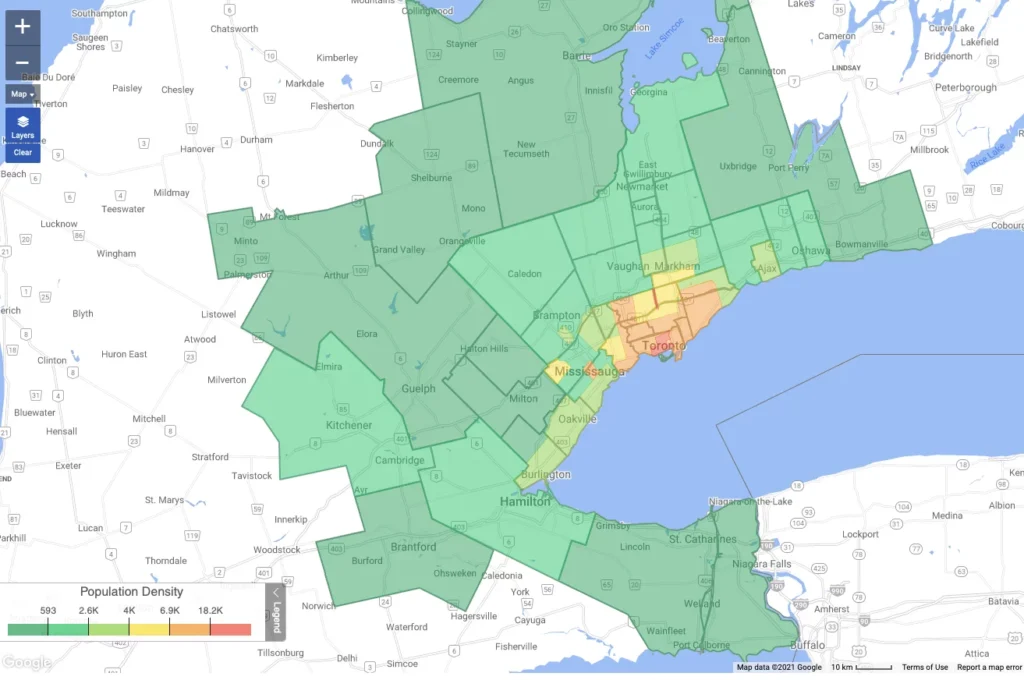

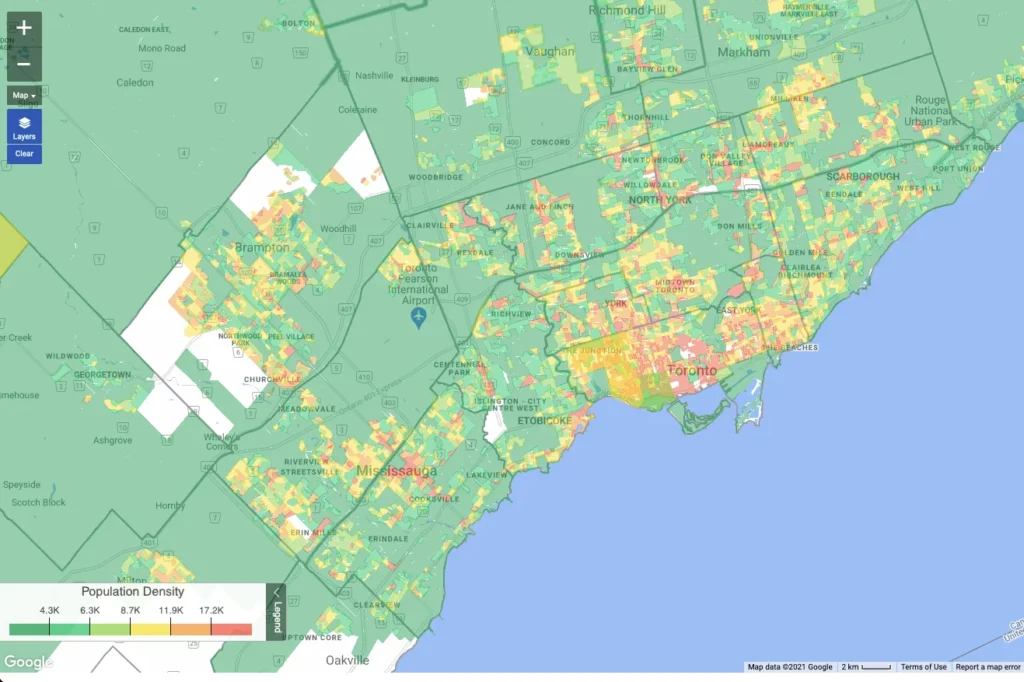

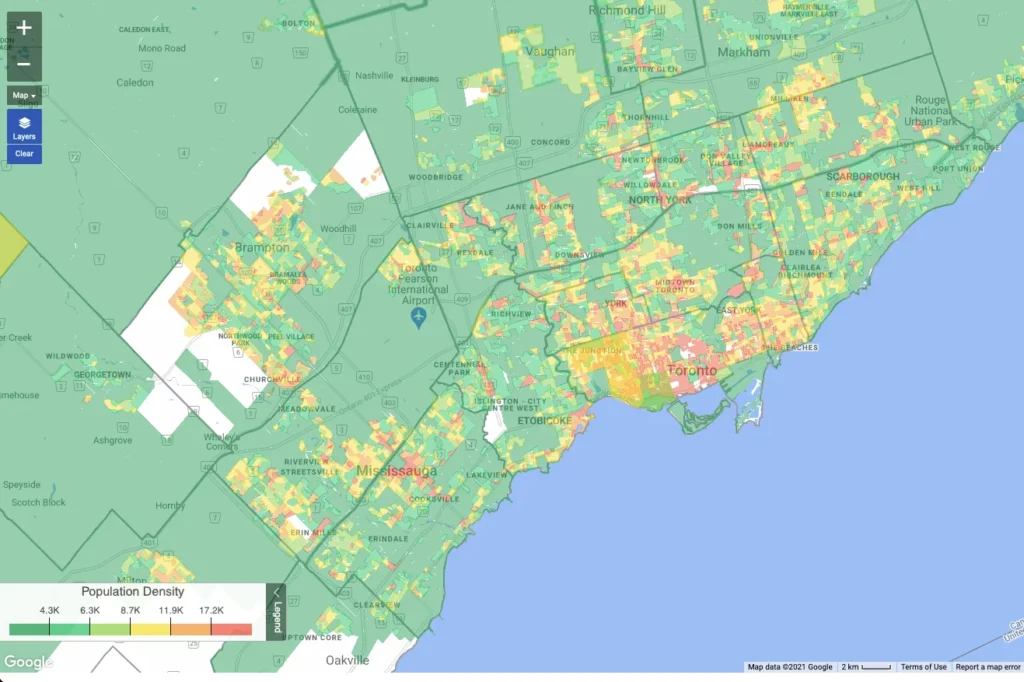

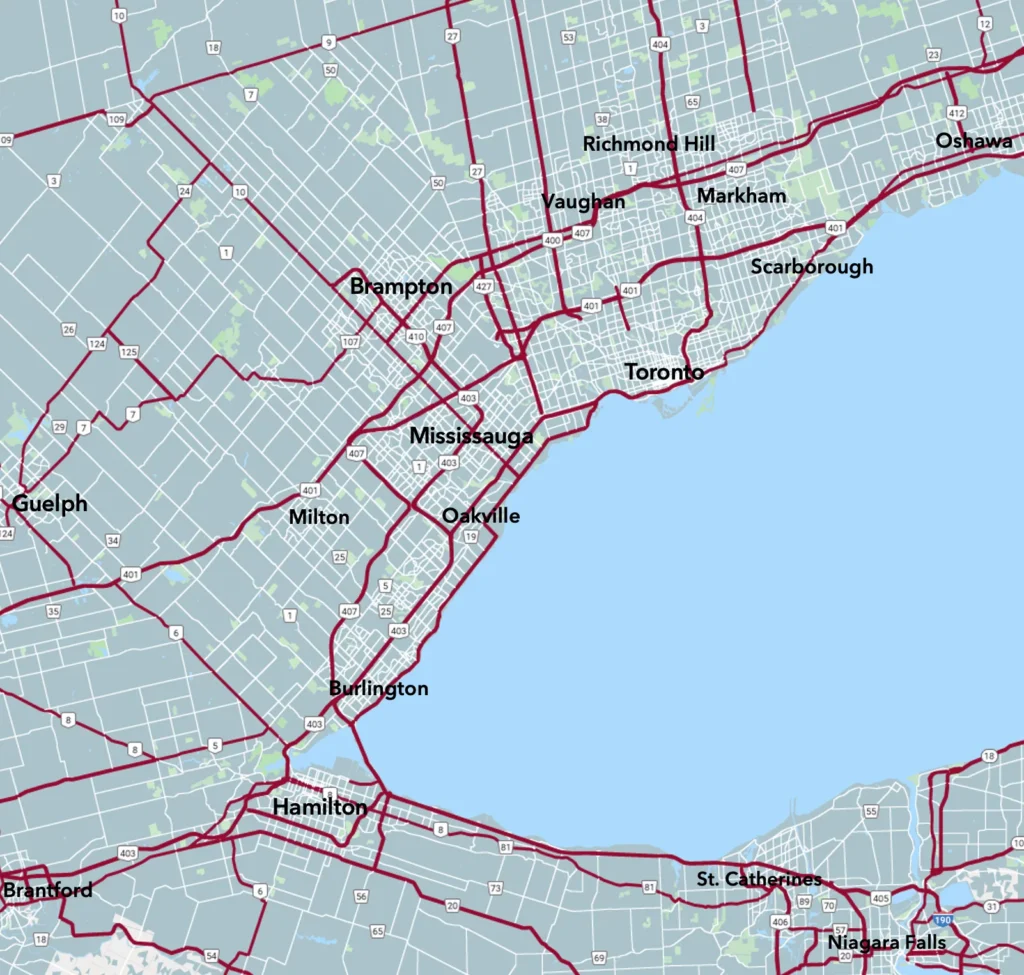

Not surprising, as shown in Figure 1, the population density in the GTA is centered around the core of the City. This is important because much of the industrial inventory tends to be in Core periphery submarkets such as North York, Etobicoke, or Scarborough, or in suburban hubs such as Vaughan, Markham, Ajax, Mississauga, Milton, and Brampton.

Fig-1: Population Density – Source: CoStar.

Figure 2 provides a clearer picture of the distribution of people within the GTA. Given the point made above, it is understandable why many Torontonians are forced to commute in one of the most gridlocked cities in North America. This congestion further underscores the importance of having a well-located industrial operation.

Fig-2: Population Density – Source: CoStar.

Location, Location, Location

Access to Market/Customer Base:

While this may not matter as much to certain industrial tenants, being close to your customers and having ‘boots on the ground’ is crucial to success. As shown in Figure 3, there are differences in household income throughout various pockets of the City. This is important because other businesses – who may be your competitors, vendors, or clients – will also likely set up shop proximally to maximize exposure to the market.

Fig-3: Median Household Income – Source: CoStar.

Access to Vendors:

Chances are, if local, your vendors will be located proximal to transportation routes and their own labour pool base. If you import raw materials or packaged goods for use in your operation, then you will likely have a bias towards proximity to intermodals, freight, air, or ports.

Access to Transportation Routes:

As mentioned earlier, having access to transportation routes is crucial not only for outbound logistics but also to better attract employees and reduce transport costs and times from suppliers, especially in a city known for its heavy traffic and congestion. The day-to-day differences may be minor in some instances, however, when understanding that:

1) Transportation costs can comprise up to 80% of total costs, and

2) Businesses seeking scale may have dozens or hundreds of shipments moving through each day…

Then it’s obvious why the most competitive companies are willing to pay a premium for location.

Within the GTA, that typically means being along Highways 400, 401, 403, 404, 407, 427, the Gardiner Expressway, or the QEW.

Fig-4: Infrastructure and Transportation Networks – Source: Google.

Your Business’ Logistics

Finally, ‘making it all work’ logistically is a function of labour, location, and your building’s features, such as: clear height, cubic volume, internal racking and warehouse management systems, shipping, outside storage, ingress/egress, and power capabilities.

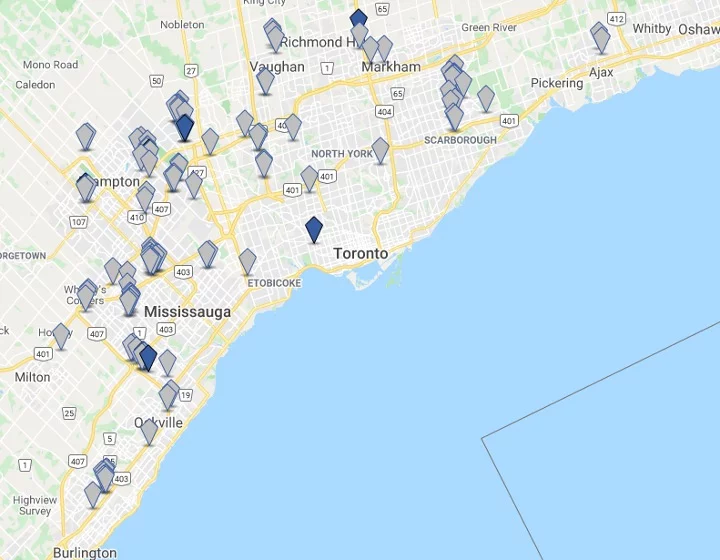

As an example, Figure 5 shows Class A industrial properties larger than 20,000 square feet that are located within 3km of 20,000 workers. Even in one of the largest, sprawling cities in North America, we can see how clusters of industrial properties have naturally formed; all in line with the criteria we have laid out above.

Fig-5: Class A Industrial Facilities over 20k SF within 3km of 20,000 workers – Source: CoStar.

Summary

Overall, there are many factors to consider when trying to identify the right property features and location within the constraints of your business’ finances and operations. Generally speaking, finding anything is becoming a challenge in the Greater Toronto Area.

For those navigating the process with a looming deadline, we would advise you to be absolutely clear on which criteria are negotiable and which are not. If time is not an issue, understanding what you want can help your real estate professional keep an eye out in their day-to-day conversations with landlords, investors, developers, and tenants.

When executed properly, this approach can help you gain leverage in a negotiation, secure the perfect facility, and realize significant cost savings, giving your business a boost to its bottom line and future growth potential.

On that note, if you would like guidance on your next renewal, relocation, or renegotiation, or for access to off-market opportunities, please contact our team today.