EXAMINING THE INVENTORY OF LOGISTICS FACILITIES IN THE GTA AND GGHA

October 21, 2021

Examining the Inventory of Logistics Facilities in the GTA and GGHA

By now, most of us are well aware of e-commerce and understand the effect is has had on our day-to-day lives. However, behind the fancy mobile apps and minute-by-minute tracking of parcels, there is a complex web of operations that keeps things running smoothly.

That is, at least, until billions of new orders were placed on the internet in response to the initial lockdowns. That consumer habit has stuck, and since then, retailers, ‘e-tailers,’ 3PLs, and transportation companies have purchased, leased, and constructed hundreds of millions of square feet of logistics and warehousing space across North America.

In the Greater Toronto Area, those same businesses are vying for Class A space that is hard to come by. For those professionals involved in the search, you may have heard the endless tirades regarding this lack of options. However, few conversations have been had about the specific properties currently available on the market.

So, with that said, let’s take a quick look at the inventory of logistics facilities in the GTA and Greater Golden Horseshoe Area.

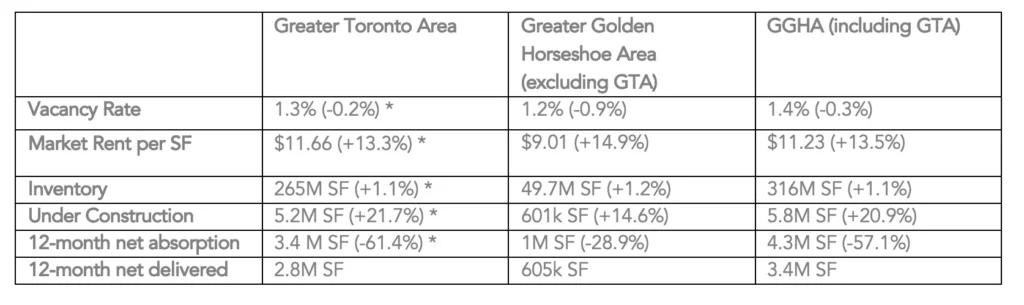

Key Performance Indicators for Logistics-Specific Facilities over 100k SF

Looking at the broad strokes, we see that the market for logistics warehouses over 100,000 square feet in the GTA and GGHA is extremely tight and robust. Construction activity has carried on – despite labour and material challenges – and absorption is slowing down as inventory falls further. This has translated into rental rates continuing to increase at a GGHA-wide-rate of 13.5% year-over-year to an average of $11.23 per SF.

Figure 1 – GTA and GGHA Logistics Market KPIs. Source: CoStar.

*year-over-year change in brackets

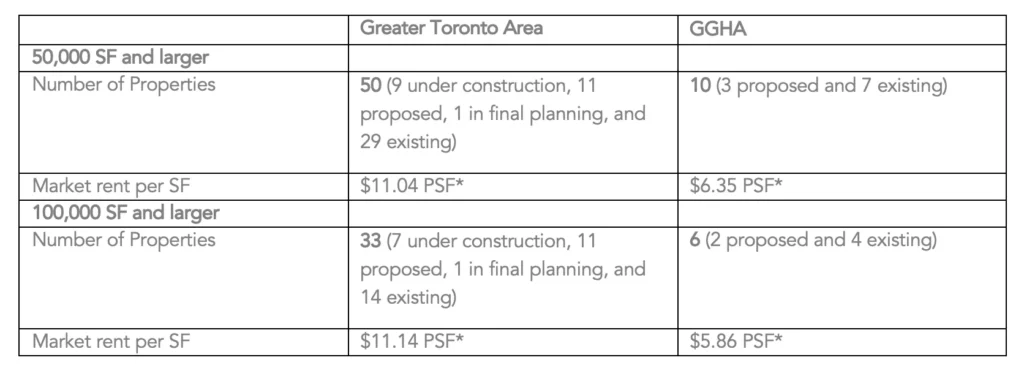

Logistics-Specific Facility Lease Availabilities

When looking at all of the logistics facilities in the GGHA that are either under construction, proposed, in final planning, or existing on-the-market, we see how very few there really are. Many of these buildings continue to be pre-leased ahead of completion, meaning businesses should expect opportunities to remain scarce.

Figure 2 – GTA and GGHA Logistics Availabilities Metrics. Source: CoStar.

*Based on available data. Rates on new construction are not always disclosed.

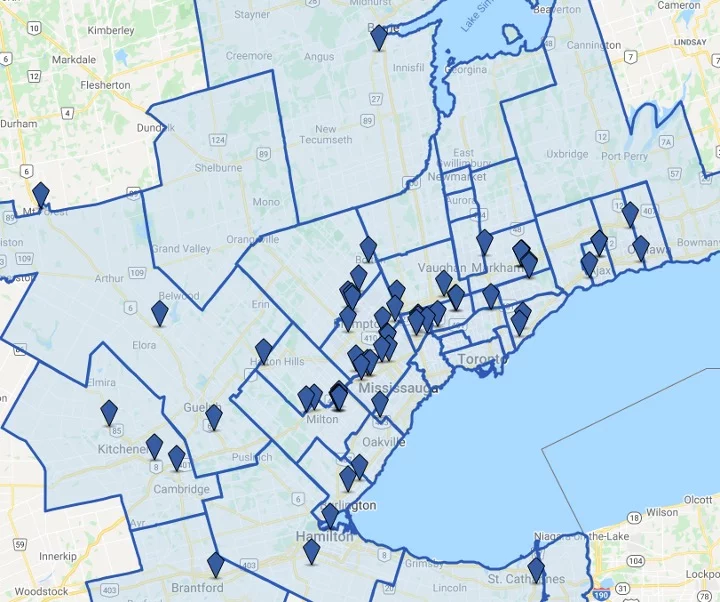

Figure – 3 – GGHA Logistics-Specific Facilities with 50,000SF+ Available. Source: CoStar.

Finally, when looking at these availabilities overlaid on a map of the GTA, we can observe the relative density of properties in the West submarkets, as well as the quickly-growing region along the 401 West corridor towards Kitchener, Guelph, Brantford, and Hamilton.

Summary

Based on our evidence, we can infer that finding space suitable for a retailer, 3PL, or transportation company will become ever-more challenging in 2022 and beyond.

If you are planning to expand your operations, or are anticipating renewing one or more leases in the next 18 to 24 months, ensure you begin the process as early as possible.

Starting late will mean coming to the negotiating table with less leverage; ultimately resulting in fewer options and a missed opportunity for cost savings.

On that note, if you would like our team to assist with your next lease or purchase, or for more market intel or off-market opportunities, please contact us directly.